Did Changing Sentiment Drive Tribal Group's (LON:TRB) Share Price Down A Worrying 63%?

For many, the main point of investing is to generate higher returns than the overall market. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Tribal Group plc (LON:TRB), since the last five years saw the share price fall 63%. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days. Of course, this share price action may well have been influenced by the 23% decline in the broader market, throughout the period.

View our latest analysis for Tribal Group

Tribal Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last five years Tribal Group saw its revenue shrink by 9.7% per year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 18% annually during that time. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

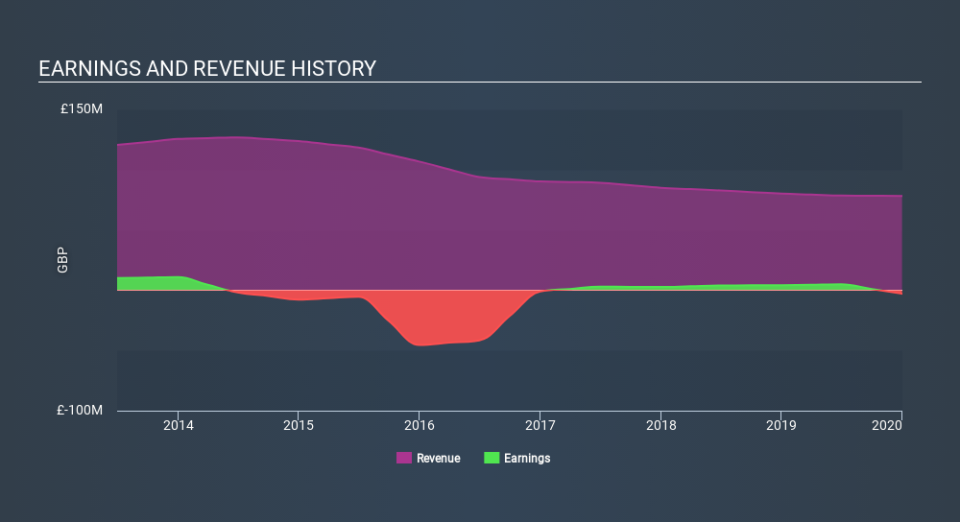

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Tribal Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Tribal Group's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Tribal Group shareholders, and that cash payout explains why its total shareholder loss of 46%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

The total return of 17% received by Tribal Group shareholders over the last year isn't far from the market return of -16%. So last year was actually even worse than the last five years, which cost shareholders 12% per year. Weak performance over the long term usually destroys market confidence in a stock, but bargain hunters may want to take a closer look for signs of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Tribal Group has 1 warning sign we think you should be aware of.

But note: Tribal Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance