Did You Manage To Avoid DBV Technologies's (EPA:DBV) Devastating 77% Share Price Drop?

While it may not be enough for some shareholders, we think it is good to see the DBV Technologies S.A. (EPA:DBV) share price up 15% in a single quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. The share price has sunk like a leaky ship, down 77% in that time. So it's about time shareholders saw some gains. The thing to think about is whether the business has really turned around.

View our latest analysis for DBV Technologies

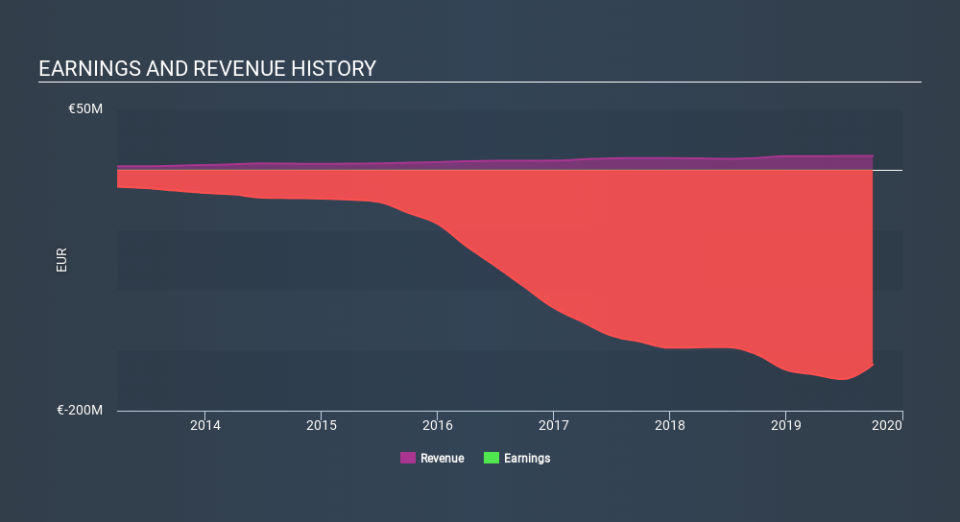

DBV Technologies isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, DBV Technologies grew revenue at 13% per year. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 38% per year is due to the revenue. It could be that the losses were much larger than expected. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that DBV Technologies shareholders have received a total shareholder return of 10% over one year. Notably the five-year annualised TSR loss of 16% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand DBV Technologies better, we need to consider many other factors. For instance, we've identified 3 warning signs for DBV Technologies (1 is concerning) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance