Did You Manage To Avoid Indivior's (LON:INDV) Devastating 88% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Even the best investor on earth makes unsuccessful investments. But serious investors should think long and hard about avoiding extreme losses. It must have been painful to be a Indivior PLC (LON:INDV) shareholder over the last year, since the stock price plummeted 88% in that time. A loss like this is a stark reminder that portfolio diversification is important. To make matters worse, the returns over three years have also been really disappointing (the share price is 81% lower than three years ago). Furthermore, it's down 61% in about a quarter. That's not much fun for holders.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Indivior

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Indivior share price fell, it actually saw its earnings per share (EPS) improve by 246%. Of course, the situation might betray previous over-optimism about growth. It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

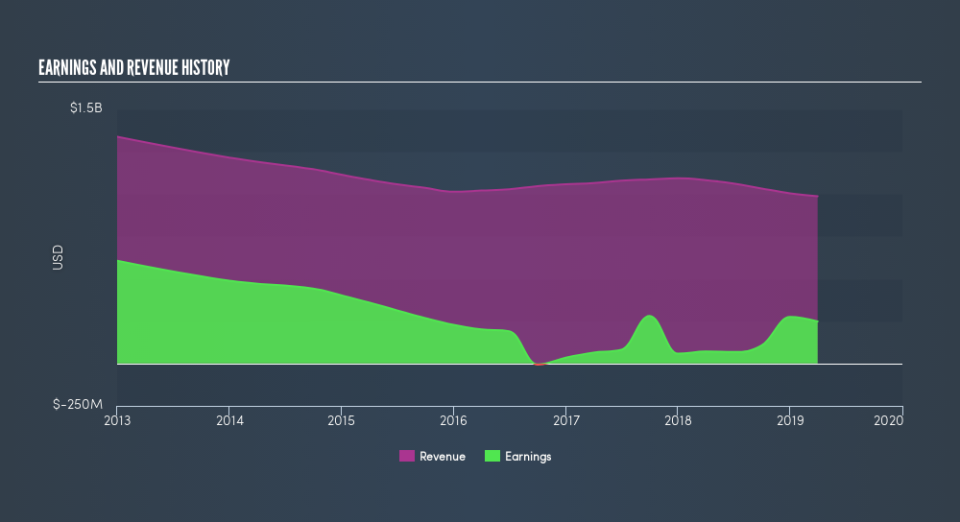

On the other hand, we're certainly perturbed by the 8.8% decline in Indivior's revenue. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We know that Indivior has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Indivior in this interactive graph of future profit estimates.

A Different Perspective

The last twelve months weren't great for Indivior shares, which cost holders 88%, while the market was up about 0.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 42% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. If you would like to research Indivior in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance