Did You Manage To Avoid Precise Biometrics's (STO:PREC) Painful 64% Share Price Drop?

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Precise Biometrics AB (publ) (STO:PREC) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 64% drop in the share price over that period. The falls have accelerated recently, with the share price down 28% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for Precise Biometrics

We don't think that Precise Biometrics's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years Precise Biometrics saw its revenue shrink by 3.3% per year. That's not what investors generally want to see. The share price decline of 29% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

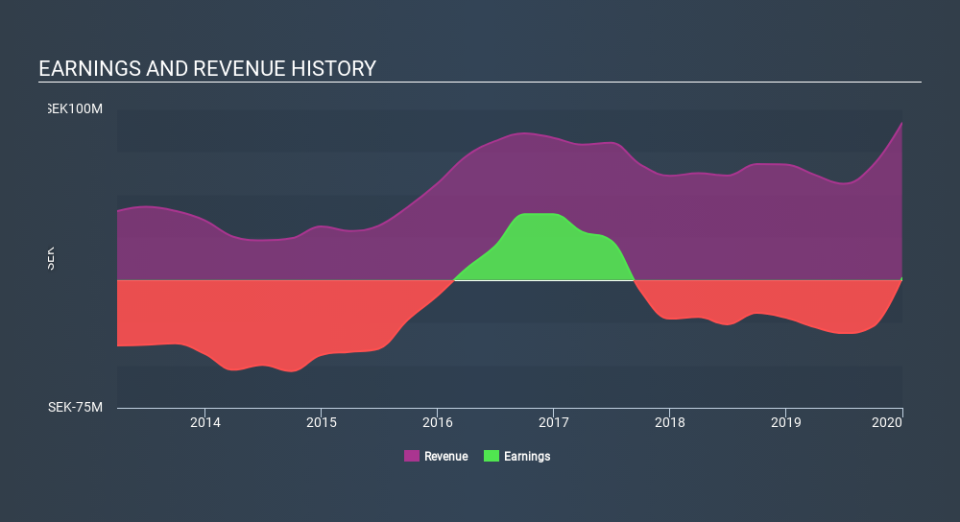

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Precise Biometrics has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Precise Biometrics will earn in the future (free profit forecasts).

A Different Perspective

While the broader market gained around 5.0% in the last year, Precise Biometrics shareholders lost 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Precise Biometrics is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance