Did You Manage To Avoid Samko Timber's (SGX:E6R) Devastating 84% Share Price Drop?

Samko Timber Limited (SGX:E6R) shareholders will doubtless be very grateful to see the share price up 122% in the last month. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Five years have seen the share price descend precipitously, down a full 84%. The recent bounce might mean the long decline is over, but we are not confident. The million dollar question is whether the company can justify a long term recovery.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Samko Timber

We don't think that Samko Timber's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

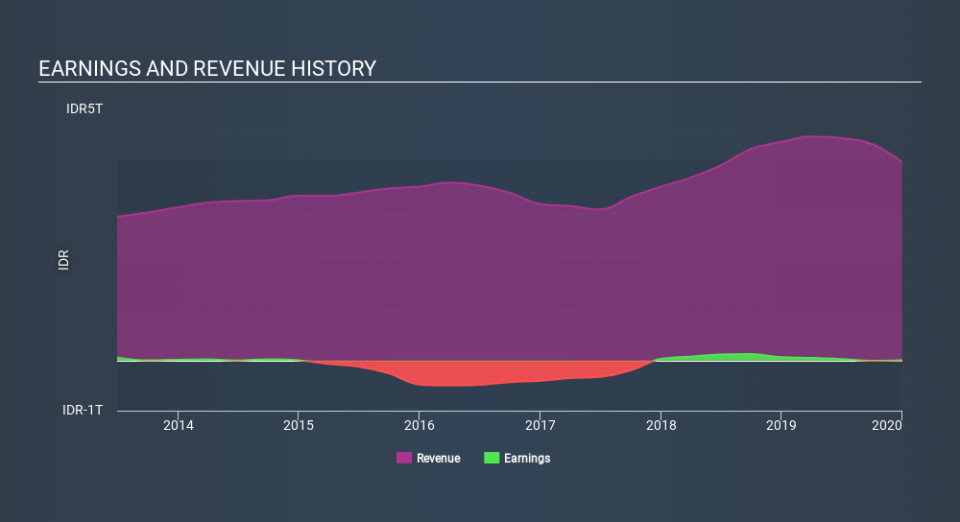

Over five years, Samko Timber grew its revenue at 6.3% per year. That's a pretty good rate for a long time period. So the stock price fall of 31% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Samko Timber's financial health with this free report on its balance sheet.

A Different Perspective

While it's certainly disappointing to see that Samko Timber shares lost 9.1% throughout the year, that wasn't as bad as the market loss of 21%. What is more upsetting is the 30% per annum loss investors have suffered over the last half decade. While the losses are slowing we doubt many shareholders are happy with the stock. It's always interesting to track share price performance over the longer term. But to understand Samko Timber better, we need to consider many other factors. For instance, we've identified 5 warning signs for Samko Timber (2 are significant) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance