Did You Manage To Avoid Solstad Offshore's (OB:SOFF) 99% Share Price Wipe Out?

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding Solstad Offshore ASA (OB:SOFF) during the five years that saw its share price drop a whopping 99%. We also note that the stock has performed poorly over the last year, with the share price down 65%. Shareholders have had an even rougher run lately, with the share price down 43% in the last 90 days. Of course, this share price action may well have been influenced by the 22% decline in the broader market, throughout the period.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Solstad Offshore

Because Solstad Offshore made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

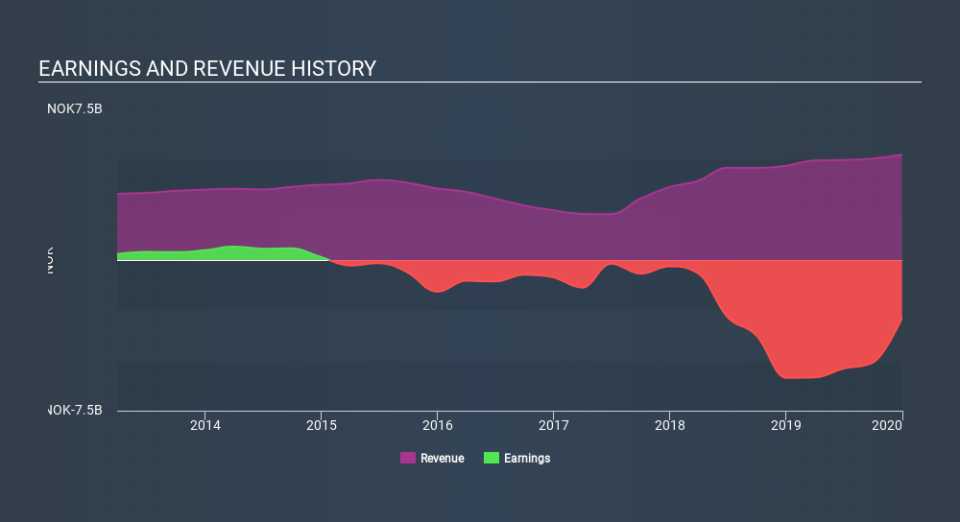

In the last half decade, Solstad Offshore saw its revenue increase by 9.2% per year. That's a pretty good rate for a long time period. So the stock price fall of 59% per year seems pretty steep. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Solstad Offshore stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Solstad Offshore shareholders are down 65% for the year. Unfortunately, that's worse than the broader market decline of 21%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 58% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Solstad Offshore is showing 4 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance