Did Miquel y Costas & Miquel, S.A. (BME:MCM) Insiders Buy Up More Shares?

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So we'll take a look at whether insiders have been buying or selling shares in Miquel y Costas & Miquel, S.A. (BME:MCM).

What Is Insider Buying?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, most countries require that the company discloses such transactions to the market.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.'

View our latest analysis for Miquel y Costas & Miquel

The Last 12 Months Of Insider Transactions At Miquel y Costas & Miquel

Over the last year, we can see that the biggest insider purchase was by Chairman of the Board Jordi Mercader Miró for €282k worth of shares, at about €15.69 per share. That means that an insider was happy to buy shares at around the current price of €15.76. That means they have been optimistic about the company in the past, though they may have changed their mind. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. In this case we're pleased to report that the insider purchases were made at close to current prices.

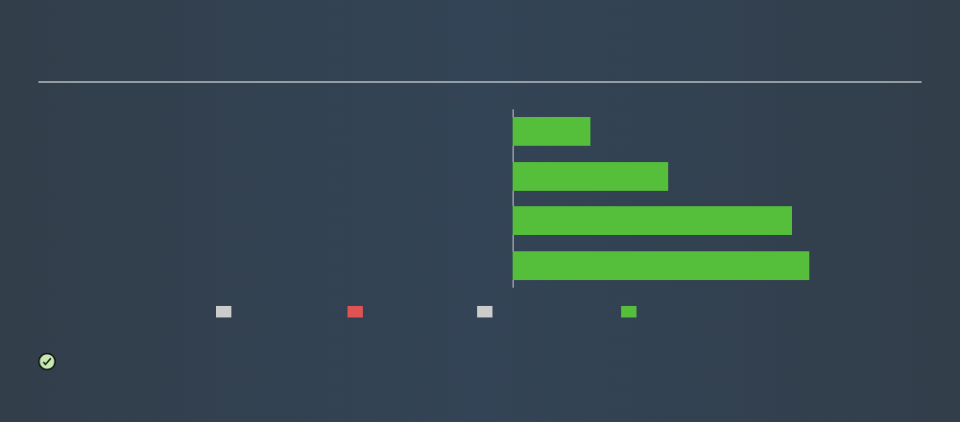

In the last twelve months insiders paid €2.2m for 156k shares purchased. Miquel y Costas & Miquel insiders may have bought shares in the last year, but they didn't sell any. They paid about €13.91 on average. Although they bought at below the recent share price, it is good to see that insiders are willing to invest in the company. The chart below shows insider transactions (by individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Miquel y Costas & Miquel is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Miquel y Costas & Miquel Insiders Bought Stock Recently

It's good to see that Miquel y Costas & Miquel insiders have made notable investments in the company's shares. GM & Director Jorge Mercader Barata spent €230k on stock, and there wasn't any selling. This could be interpreted as suggesting a positive outlook.

Insider Ownership of Miquel y Costas & Miquel

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Miquel y Costas & Miquel insiders own about €69m worth of shares. That equates to 14% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The Miquel y Costas & Miquel Insider Transactions Indicate?

It's certainly positive to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. Given that insiders also own a fair bit of Miquel y Costas & Miquel we think they are probably pretty confident of a bright future. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance