Did You Miss Arco Platform's (NASDAQ:ARCE) Impressive 103% Share Price Gain?

When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Arco Platform Limited (NASDAQ:ARCE) share price has soared 103% return in just a single year. In the last week the share price is up 2.3%. Arco Platform hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Arco Platform

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

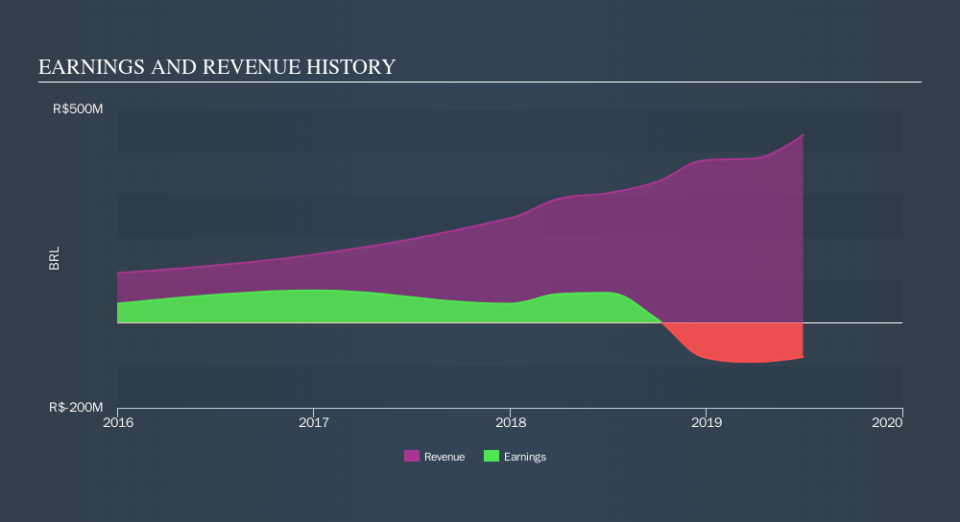

Over the last twelve months Arco Platform went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

We think that the revenue growth of 45% could have some investors interested. Many businesses do go through a faze where they have to forgo some profits to drive business development, and sometimes its for the best.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Arco Platform's financial health with this free report on its balance sheet.

A Different Perspective

Arco Platform boasts a total shareholder return of 103% for the last year. That's better than the more recent three month gain of 5.5%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Arco Platform may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance