Did You Miss Ceres Power Holdings's (LON:CWR) Impressive 178% Share Price Gain?

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. Long term Ceres Power Holdings plc (LON:CWR) shareholders would be well aware of this, since the stock is up 178% in five years. Also pleasing for shareholders was the 21% gain in the last three months. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

View our latest analysis for Ceres Power Holdings

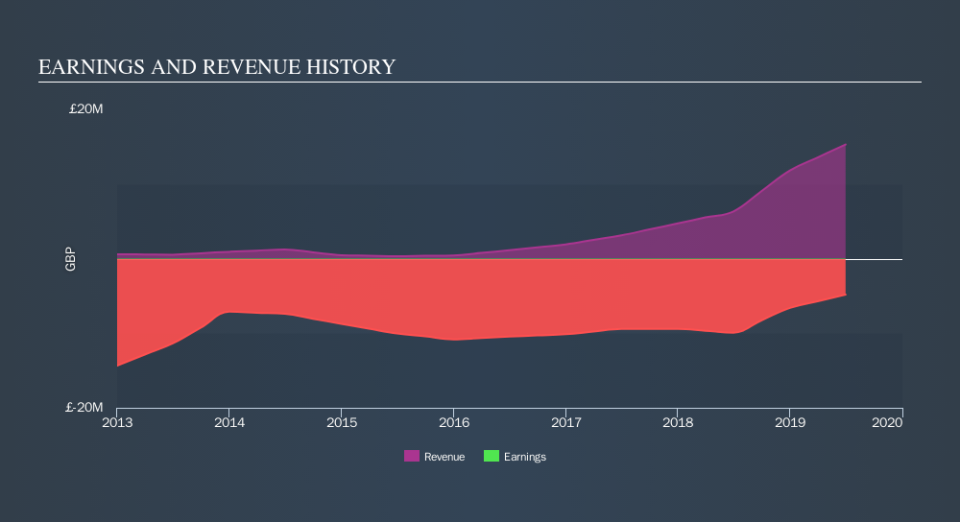

Ceres Power Holdings isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Ceres Power Holdings saw its revenue grow at 64% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 23% per year, compound, during the period. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes Ceres Power Holdings worth investigating - it may have its best days ahead.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Ceres Power Holdings's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Ceres Power Holdings shareholders have received a total shareholder return of 30% over the last year. That gain is better than the annual TSR over five years, which is 23%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance