Did You Miss Mercury Systems' (NASDAQ:MRCY) Whopping 318% Share Price Gain?

It might be of some concern to shareholders to see the Mercury Systems, Inc. (NASDAQ:MRCY) share price down 11% in the last month. But that doesn't change the fact that the returns over the last half decade have been spectacular. Indeed, the share price is up a whopping 318% in that time. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 17% drop, in the last year.

View our latest analysis for Mercury Systems

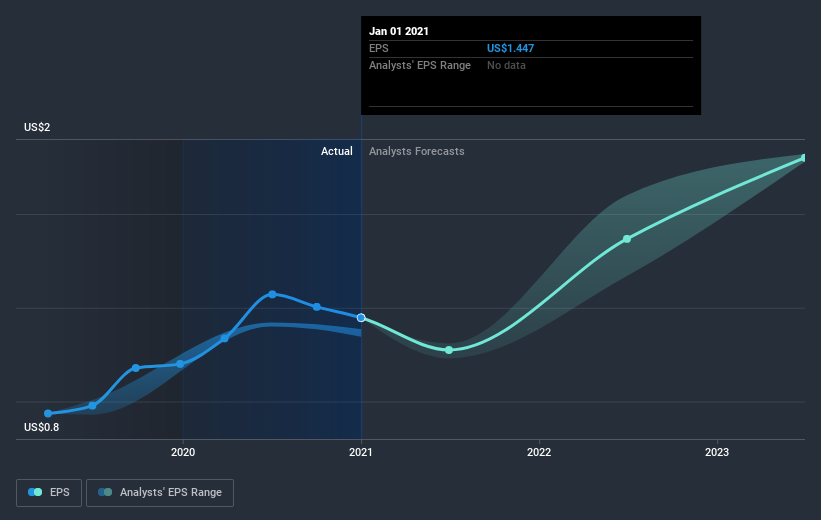

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Mercury Systems managed to grow its earnings per share at 20% a year. This EPS growth is slower than the share price growth of 33% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This optimism is visible in its fairly high P/E ratio of 48.97.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Mercury Systems has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

While the broader market gained around 32% in the last year, Mercury Systems shareholders lost 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 33% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Mercury Systems is showing 1 warning sign in our investment analysis , you should know about...

Of course Mercury Systems may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance