Did Tenet Healthcare's (NYSE:THC) Share Price Deserve to Gain 98%?

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. For example, Tenet Healthcare Corporation (NYSE:THC) shareholders have seen the share price rise 98% over three years, well in excess of the market return (41%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 75% in the last year.

See our latest analysis for Tenet Healthcare

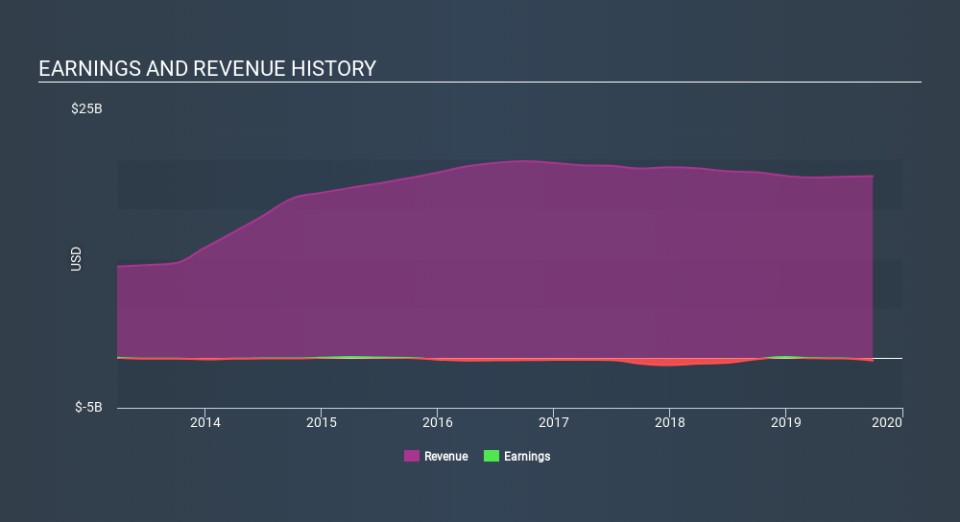

Tenet Healthcare wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Tenet Healthcare actually saw its revenue drop by 2.9% per year over three years. The revenue growth might be lacking but the share price has gained 26% each year in that time. Unless the company is going to make profits soon, we would be pretty cautious about it.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Tenet Healthcare is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that Tenet Healthcare has rewarded shareholders with a total shareholder return of 75% in the last twelve months. That certainly beats the loss of about 3.3% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Tenet Healthcare better, we need to consider many other factors. Take risks, for example - Tenet Healthcare has 1 warning sign we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance