What Did Unite Group's (LON:UTG) CEO Take Home Last Year?

Richard Smith became the CEO of The Unite Group plc (LON:UTG) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Unite Group.

Note: The company does not report funds from operations, and as a result, we have used earnings per share in our analysis.

See our latest analysis for Unite Group

How Does Total Compensation For Richard Smith Compare With Other Companies In The Industry?

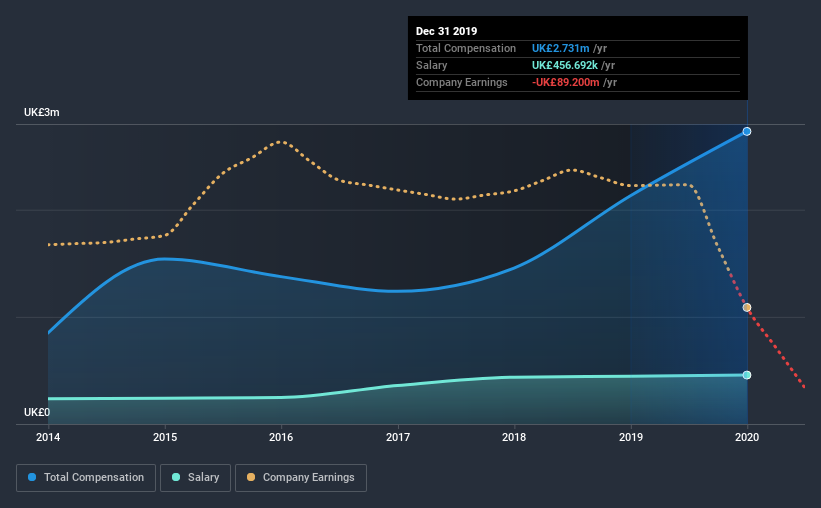

Our data indicates that The Unite Group plc has a market capitalization of UK£3.3b, and total annual CEO compensation was reported as UK£2.7m for the year to December 2019. Notably, that's an increase of 28% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£457k.

On comparing similar companies from the same industry with market caps ranging from UK£1.6b to UK£5.0b, we found that the median CEO total compensation was UK£1.3m. This suggests that Richard Smith is paid more than the median for the industry. Moreover, Richard Smith also holds UK£1.9m worth of Unite Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2019 | 2018 | Proportion (2019) |

Salary | UK£457k | UK£446k | 17% |

Other | UK£2.3m | UK£1.7m | 83% |

Total Compensation | UK£2.7m | UK£2.1m | 100% |

On an industry level, around 38% of total compensation represents salary and 62% is other remuneration. It's interesting to note that Unite Group allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at The Unite Group plc's Growth Numbers

The Unite Group plc has reduced its earnings per share by 70% a year over the last three years. It achieved revenue growth of 40% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has The Unite Group plc Been A Good Investment?

With a total shareholder return of 24% over three years, The Unite Group plc shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

As previously discussed, Richard is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. On the other hand, revenues will undoubtedly inspire confidence since they've been growing at a healthy pace recently. Shareholder returns, while also growing, haven't impressed us that much during the same stretch. EPS growth, meanwhile, has been negative. But we don't think the high CEO compensation is a huge problem.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Unite Group (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Important note: Unite Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance