Digimarc Corp (DMRC) Q1 2024 Earnings: Surpasses Revenue Forecasts Despite Wider Net Loss

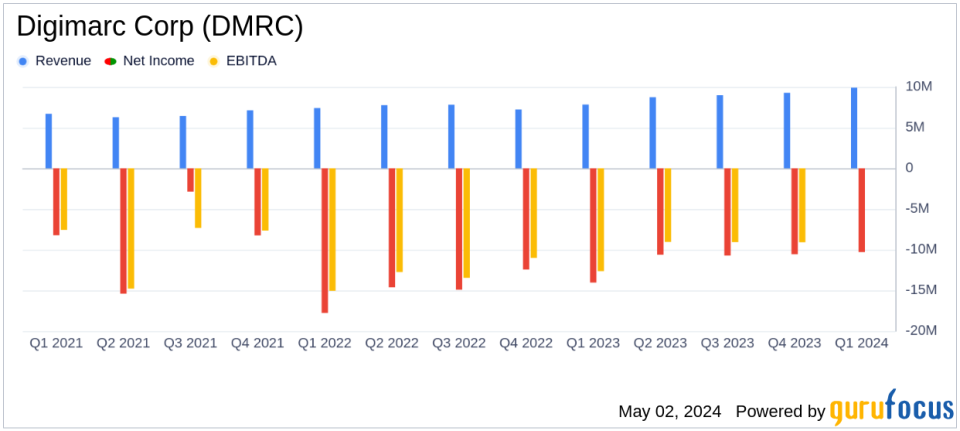

Total Revenue: Reached $9.9 million in Q1 2024, up from $7.8 million in Q1 2023, exceeding the estimate of $9.58 million.

Net Loss: Reported at $10.3 million in Q1 2024, an improvement from a net loss of $14.0 million in Q1 2023, and below the estimated net loss of $10.82 million.

Earnings Per Share (EPS): Recorded at -$0.50, showing improvement from -$0.70 year-over-year, still above the estimated -$0.31.

Gross Profit Margin: Increased to 63% in Q1 2024 from 54% in Q1 2023, indicating a significant improvement in profitability.

Operating Expenses: Decreased to $17.1 million in Q1 2024 from $19.0 million in Q1 2023, reflecting more efficient operational management.

Cash Reserves: Ended the quarter with $48.9 million in cash, cash equivalents, and marketable securities, a substantial increase from $27.2 million at the end of the previous quarter.

Subscription Revenue: Grew to $5.8 million in Q1 2024, up 49% from $3.9 million in Q1 2023, driven by new and existing commercial contracts.

Digimarc Corp (NASDAQ:DMRC) released its 8-K filing on May 2, 2024, revealing a mix of robust revenue growth and a continued net loss for the first quarter ended March 31, 2024. The company, a leader in digital watermarking technologies, reported a significant 85% increase in Annual Recurring Revenue and a substantial improvement in subscription gross profit margin.

Financial Highlights and Analyst Expectations

Digimarc's total revenue for Q1 2024 reached $9.9 million, up from $7.8 million in the same quarter last year, surpassing the analyst estimate of $9.58 million. This increase was primarily driven by a 52% growth in commercial subscription revenue, which climbed to $5.8 million. Service revenue also saw a slight increase to $4.2 million. Despite the positive revenue trajectory, the company reported a net loss of $10.3 million, or $0.50 per share, which did not meet the estimated loss of $0.31 per share and was wider than the forecasted net income loss of $10.82 million.

Operational and Market Performance

The gross profit margin improved notably from 54% to 63% year-over-year, with the subscription segment's gross margin expanding to an impressive 87%. This margin enhancement reflects the company's strategic focus on high-margin subscription revenue, which is critical for long-term sustainability. Operating expenses decreased to $17.1 million from $19.0 million, indicating effective cost management and operational efficiency.

Strategic Initiatives and Future Outlook

CEO Riley McCormack emphasized the company's commitment to converting its large Total Addressable Market (TAM) into substantial free cash flow through sustained high growth and world-class operating margins. The significant increase in cash and cash equivalents, from $27.2 million at the end of 2023 to $48.9 million, provides Digimarc with a solid financial foundation to support its strategic initiatives and buffer against operational uncertainties.

Investor and Market Implications

The positive developments in revenue and gross margins are likely to bolster investor confidence in Digimarc's business model and market strategy, particularly in its ability to scale high-margin products. However, the wider net loss compared to estimates might raise concerns about the pace of profitability. The company's focus on enhancing operational efficiencies and expanding its subscription base is expected to play a crucial role in improving its financial health over the coming quarters.

Conclusion

While Digimarc's Q1 2024 results highlight significant revenue growth and improvements in gross margins, the challenge remains to mitigate losses and move towards profitability. The company's robust increase in cash reserves and reduction in operating expenses reflect a strategic alignment towards achieving long-term financial stability and growth. Investors and stakeholders will likely watch closely how Digimarc leverages its technological capabilities and market opportunities to improve its bottom line in future quarters.

Explore the complete 8-K earnings release (here) from Digimarc Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance