Is Diploma (LON:DPLM) a quality stock worth paying up for?

It’s a persistently tricky investment question… to what extent should valuation influence your decision to buy the market’s highest quality stocks?

For some, there’s rarely a bad time to buy shares in good quality firms. After all, if you get your research right, a resilient and highly profitable stock might compound your returns for many years.

But for others, a rich valuation can keep stocks like this almost permanently out of reach. Even when markets plummet, higher quality names can stay relatively expensive.

One company that arguably falls into this category is Machinery, Equipment & Components group, Diploma (LON:DPLM).

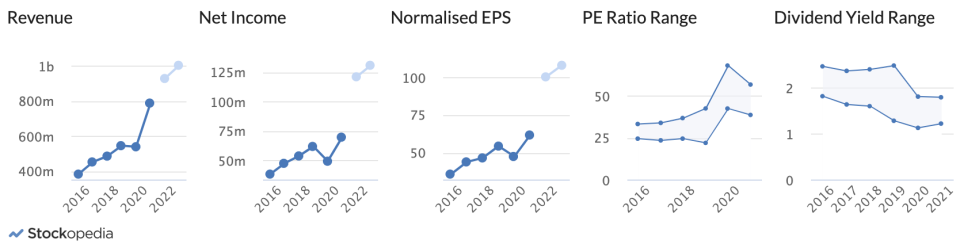

Over the past five years, shares in Diploma have delivered a return of 130.9% relative to the market. Yet, over that same period, the average price-to-earnings ratio on the stock has been 32.9. By most usual standards, that’s expensive enough to put many investors off. So what are buyers getting?

GET MORE DATA-DRIVEN INSIGHTS INTO LON:DPLM »

Hunting for durable profitability

Part of the appealing draw for investors is that Diploma has a number of consistently high quality traits. In particular:

Its Sales and Earnings are stable and growing

It has strong Operating Margins

It has an above average Return on Capital Employed

It has a strong Return on Equity

It has a stable and growing dividend

These kinds of factors appeal to quality-focused professional money managers like Terry Smith and Nick Train. Train has described his approach as targeting durable, cash generative franchises and then owning those quality-growth companies over the long term.

Part of the reason why these firms are attractive is that their financial strength can protect them from competitive pressures as well as economic turbulence. Here’s how that plays out in the numbers:

With a five-year average Operating Margin of 14.4%, Diploma is way ahead of the industry average. That suggests it has strong pricing power, which is extremely useful in an inflationary environment because it helps to protect it from the impact of rising input prices.

Such a strong profitability indicator is part of the reason why the group has seen its Earnings Per Share grow at a compound rate of 11.5% over the past five years.

With a long-term average Return on Capital Employed of 19.0%, Diploma appears to have been able to recirculate its earnings in order to grow efficiently over time. This ratio measures the profits that a business gets from investing in itself - and the signs here are strong.

Equally, a Return on Equity of 16.7% is also very solid and suggests that the group is deploying its capital well in order to generate profits.

Strong sales, net profits and earnings per share have meant that the stock’s PE ratio has remained relatively high over the past five years - and this is where you can see that investors are having to pay up for quality.

A final point to note is the group’s dividend. The current yield on the stock stands at 1.83%, with the 5-year average at 1.89%. While the yield is modest, the payout growth is eye-catching for its consistency - having risen more than five times over the past 10 years. This points to a progressive approach by management. Over 5 years, the dividend per share has grown at a compound rate of 16.3% - and it currently stands at 0.43p.

Paying up for profit

Investors in search of stocks with the potential to re-rate many times tend to look for ideas at the smaller end of the market. Yet Diploma shows that growth is more than achievable in large-caps and their shares can deliver above-average returns over many years.

One of the biggest attractions with this stock appears to be its robust and well-defended profitability. Its consistent track record and positive earnings trend have resulted in a rich valuation. And while no stock is ever immune from setbacks, investors are clearly prepared to pay up for these quality traits.

What does this mean for potential investors?

Finding good quality stocks with the potential to compound your returns over time is a strategy used by some of the world's most successful investors. To find out more, you can explore the company's StockReport here.

Yahoo Finance

Yahoo Finance