Discover Basic-Fit And Two More Growth Leaders With High Insider Stakes On Euronext Amsterdam

As global markets navigate through varying economic signals, the Netherlands continues to present intriguing investment opportunities on Euronext Amsterdam. In this context, companies like Basic-Fit with high insider ownership can be compelling as they often indicate a strong commitment from those who know the company best.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

Name | Insider Ownership | Earnings Growth |

BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

Ebusco Holding (ENXTAM:EBUS) | 33.2% | 114.0% |

Envipco Holding (ENXTAM:ENVI) | 36.2% | 68.9% |

MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

Basic-Fit (ENXTAM:BFIT) | 12% | 64.8% |

PostNL (ENXTAM:PNL) | 35.8% | 23.9% |

Underneath we present a selection of stocks filtered out by our screen.

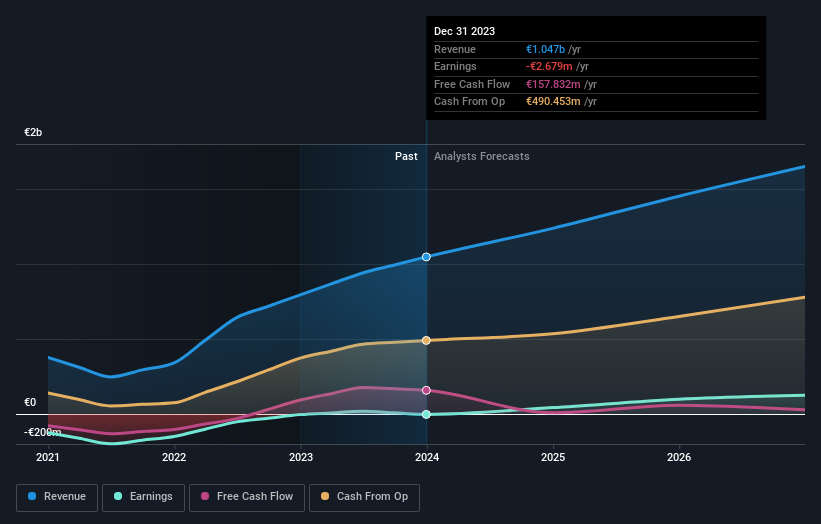

Basic-Fit

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V. operates a chain of fitness clubs across Europe, with a market capitalization of approximately €1.43 billion.

Operations: The company generates revenue primarily from two segments: Benelux, which contributes €479.04 million, and France, Spain & Germany combined, contributing €568.21 million.

Insider Ownership: 12%

Return On Equity Forecast: 27% (2026 estimate)

Basic-Fit, a fitness chain in the Netherlands, shows promising growth with earnings expected to increase significantly. The company's Return on Equity is predicted to reach 26.7% in three years, indicating efficient profitability relative to shareholder equity. Recent insider activities reflect more purchases than sales, suggesting confidence among insiders despite not being in large volumes. Analysts are optimistic about the stock price, anticipating a substantial rise. Revenue growth projections for Basic-Fit outpace the general Dutch market, although it's below the high-growth benchmark of 20% per year.

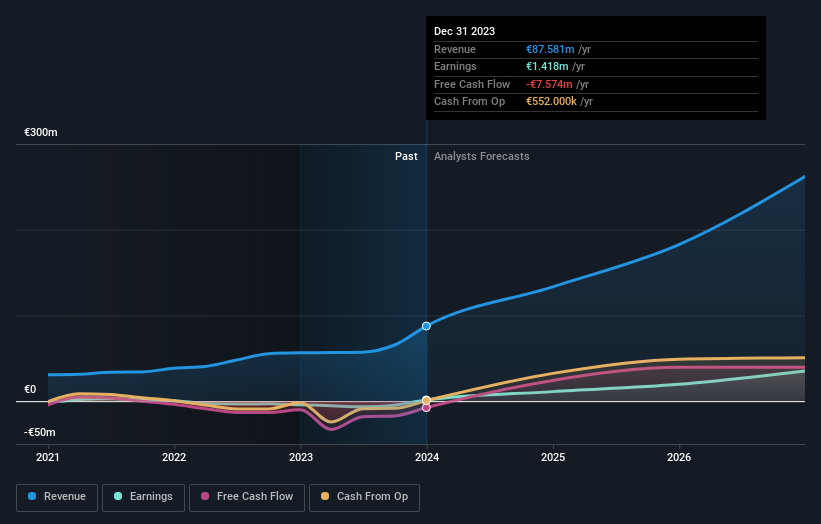

Envipco Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and selling or leasing reverse vending machines (RVMs) for recycling used beverage containers, primarily operating in the Netherlands, North America, and Europe with a market capitalization of approximately €334.60 million.

Operations: The company generates its revenue by designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers across the Netherlands, North America, and Europe.

Insider Ownership: 36.2%

Return On Equity Forecast: N/A (2027 estimate)

Envipco Holding N.V. has demonstrated a strong turnaround, with its first quarter sales jumping to €27.44 million from €10.41 million year-over-year and shifting from a net loss to a profit of €0.147 million. The company's revenue is expected to grow by 33.3% annually, outpacing the Dutch market's 9.9%. Earnings are also projected to surge by 68.9% per year over the next three years, reflecting robust growth prospects despite high share price volatility and recent shareholder dilution.

PostNL

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. operates in postal and logistics services, catering to both businesses and consumers primarily in the Netherlands and other parts of Europe, with a market capitalization of approximately €0.63 billion.

Operations: PostNL's revenue is derived from its packages and mail services, with €2.25 billion from packages and €1.35 billion from mail in the Netherlands.

Insider Ownership: 35.8%

Return On Equity Forecast: 26% (2027 estimate)

PostNL, a Dutch postal service provider, faces challenges with a highly volatile share price and significant debt levels. Recent financial performance shows a downturn, with sales dropping to €763 million and a net loss of €20 million in the first quarter of 2024. Despite these setbacks, PostNL is expected to see earnings growth of 23.9% annually over the next three years, outpacing the broader Dutch market's forecasted 18% growth. The company also recently engaged in sustainable financing efforts through two fixed-income offerings totaling approximately €298.67 million each, underscoring its commitment to sustainability-linked initiatives.

Click to explore a detailed breakdown of our findings in PostNL's earnings growth report.

Our valuation report unveils the possibility PostNL's shares may be trading at a discount.

Taking Advantage

Investigate our full lineup of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTAM:BFIT ENXTAM:ENVI and ENXTAM:PNL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com