Can Discover Financial (DFS) Q1 Earnings Beat on Card Sales?

Discover Financial Services DFS will release first-quarter 2018 results on Apr 26 after market close.

Discover Financial has been witnessing consistent growth in card sales over the past several years, thereby adding to its revenue base. The same trend is expected to continue in the first quarter as well. The Zacks Consensus Estimate for card sales is pegged at $30.5 billion, reflecting year-over-year growth of 4.8%.

Although the company’s Payments Service segment has been underperforming over the past few years, it has nonetheless taken measures to reap profits from the same. Evidently, the segment’s decent performance in the last two quarters underlines the company’s efforts on this front. The Zacks Consensus Estimate for the segment’s total transaction volume stands at $51.8 billion, translating into a 10% year-over-year rise.

Other Factors

The company is expected to witness further loan growth in the quarter to be reported, continuing with the previous trend, which is likely to favor the top line.

Discover Financial’s frequent share buyback programs are expected to impact the bottom line positively by reducing the outstanding share count.

However, the company’s extensive marketing and business development activities are likely to hurt its earnings in the to-be-reported quarter.

In addition, rising level of debt resulting into increasing interest expenses, is anticipated to have put pressure on the bottom line in the first quarter.

Earnings Whispers

Our proven model does not conclusively show that Discover Financial is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here as you will see below.

Zacks ESP: Discover Financial has an Earnings ESP of -1.36%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

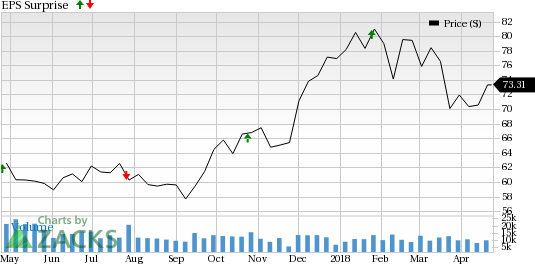

Discover Financial Services Price and EPS Surprise

Discover Financial Services Price and EPS Surprise | Discover Financial Services Quote

Zacks Rank: Discover Financial carries a Zacks Rank #3, which increases the predictive power of ESP. However, a company needs to have a positive ESP to be confident about an earnings surprise. Hence, this combination leaves surprise prediction inconclusive.

We caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies from the Finance sector that you may want to consider as these have the right combination of elements to deliver an earnings beat this time around:

Aflac Incorporated AFL has an Earnings ESP of +1.73% and a Zacks Rank #2. The company is set to report first-quarter earnings on Apr 25. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nasdaq, Inc. NDAQ has an Earnings ESP of +0.31% and a Zacks Rank of 3. The company is set to report first-quarter earnings on Apr 25.

ConnectOne Bancorp, Inc. CNOB has an Earnings ESP of +2.86% and is a Zacks #3 Ranked player. The company is set to report first-quarter earnings on Apr 25.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConnectOne Bancorp, Inc. (CNOB) : Free Stock Analysis Report

Discover Financial Services (DFS) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance