Discover Financial (DFS) Q4 Earnings Top Estimates, Rise Y/Y

Discover Financial Services’ DFS fourth-quarter 2019 adjusted earnings of $2.25 beat the Zacks Consensus Estimate by 0.9%. Moreover, the bottom line improved 10.8% year over year on higher revenues and loan growth. The Payments Services segment witnessed significant growth in the fourth quarter.

Operational Update

In the reported quarter, the company’s revenues — net of interest expenses — increased 5% year over year to $2.9 billion, driven by higher net interest income, and discount and interchange revenues. However, the top line missed the Zacks Consensus Estimate by 0.1%.

Total loans grew 6% year over year to $95.9 billion.

Interest expenses of $615 million increased 1.7% year over year.

Total other expenses rose 6.7% to $1.18 billion due to higher employee compensation and benefits, information processing and communications, and professional fees.

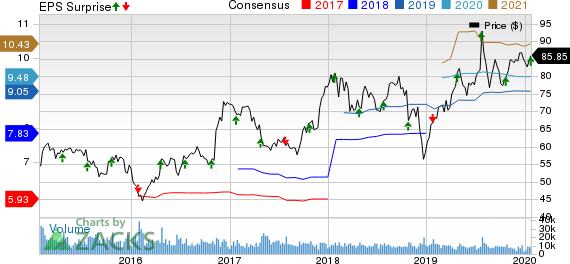

Discover Financial Services Price, Consensus and EPS Surprise

Discover Financial Services price-consensus-eps-surprise-chart | Discover Financial Services Quote

Segmental Update

Direct Banking Segment

This segment’s pre-tax income inched up 1% to $883 million owing to more net interest income. However, the same was largely offset by a rise in provision for loan losses and higher operating expenses.

Total loans climbed 6% year over year to $95.9 billion. Credit card loans augmented 6% to $77.2 billion.

Personal loans ascended 3% while private student loans rose 3%, both on a year-over-year basis. Private student loans excluding purchased student loans also shot up 9% year over year.

Net interest income increased 5% year over year, backed by loan growth. Net interest margin was 10.29%, down 6 basis points from the year-ago quarter.

Payment Services Segment

Payment Services pre-tax income was $41 million in the quarter under review, up 78.3% from the year-earlier period owing to higher revenues, aided by transaction volume growth from PULSE and Network Partners businesses.

Payment Services volume was up 9% from the prior-year period.

PULSE dollar volume expanded 6% year over year, fueled by the impact of new issuers and acquiring relationships on the network and strong growth from existing issuers and acquirers.

Diners Club volume grew 1.5% from the year-earlier quarter.

Network Partners volume expanded 52%, backed by AribaPay.

Strong Financial Position

Discover Financial had total assets worth $113.9 billion as of Dec 31, 2019, up 4.1% year over year.

Total liabilities as of Dec 31, 2019 were $102.1 billion, up 3.8% year over year.

Total equity was $11.8 billion on Dec 31, 2019, up 6.5% year over year.

Discover Financial’s return on equity for the fourth quarter was 24%.

Share Repurchase Update

During the quarter under review, the company repurchased approximately 4.9 million shares of common stock for $401 million.

Shares of common stock outstanding dipped 1.5% from the previously reported quarter’s tally.

Zacks Rank

Discover Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases From Finance Sector

Some stocks worth considering from the finance sector with a perfect mix of elements to surpass estimates in the upcoming quarterly releases are as follows:

AXA Equitable Holdings, Inc. EQH is slated to announce fourth-quarter earnings on Feb 27. The stock has an Earnings ESP of +2.68% and a Zacks Rank #2 (Buy).

Moody's Corporation MCO has an Earnings ESP of +1.00% and a Zacks Rank of 2. The company is scheduled to release fourth-quarter earnings on Feb 12.

ProAssurance Corporation PRA is set to report fourth-quarter earnings on Feb 20. The stock is Zacks #2 Ranked and has an Earnings ESP of +36.71%.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moody's Corporation (MCO) : Free Stock Analysis Report

Discover Financial Services (DFS) : Free Stock Analysis Report

ProAssurance Corporation (PRA) : Free Stock Analysis Report

AXA Equitable Holdings, Inc. (EQH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance