Discovering 3 Hidden German Small Caps with Strong Potential

The German market has been buoyed by a recent interest rate cut from the European Central Bank, which has contributed to a 2.17% rise in Germany's DAX index. This positive sentiment provides an opportune moment to explore lesser-known small-cap stocks that could offer significant growth potential. In this environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals and unique market positions that can thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

Westag | NA | -1.56% | -21.68% | ★★★★★★ |

FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

CropEnergies

Simply Wall St Value Rating: ★★★★★★

Overview: CropEnergies AG manufactures and distributes bioethanol and other biofuels produced from grain or other agricultural raw materials in Germany and internationally, with a market cap of €1.17 billion.

Operations: The primary revenue stream for CropEnergies AG is bioethanol, generating €3.82 million.

CropEnergies, a small cap player in the bioethanol industry, has shown resilience despite recent challenges. The company is debt-free and reported €4M in revenue. However, it faced a significant earnings drop of 92.8% over the past year, contrasting sharply with the oil and gas sector's average growth of 27.6%. Despite this setback, CropEnergies' high-quality earnings and lack of debt position it well for potential recovery as market conditions stabilize.

Eckert & Ziegler

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide, with a market cap of €913.87 million.

Operations: The company's primary revenue streams are from its Medical segment (€132.80 million) and Isotope Products segment (€150.97 million).

Eckert & Ziegler, a notable player in the medical equipment sector, reported Q2 2024 sales of €77.76 million and net income of €9.54 million, up from €60.03 million and €6.17 million respectively last year. Basic earnings per share rose to €0.52 from €0.34 a year ago, reflecting strong performance metrics like a 31.6% earnings growth over the past year and EBIT covering interest payments 20 times over. With debt reduced from 14.7% to 9.5% in five years, it trades at an attractive valuation well below fair value estimates.

Unlock comprehensive insights into our analysis of Eckert & Ziegler stock in this health report.

Understand Eckert & Ziegler's track record by examining our Past report.

RHÖN-KLINIKUM

Simply Wall St Value Rating: ★★★★★☆

Overview: RHÖN-KLINIKUM Aktiengesellschaft, together with its subsidiaries, offers in-patient, semi-patient, and outpatient healthcare services in Germany and has a market cap of €836.73 million.

Operations: RHÖN-KLINIKUM's primary revenue streams include acute hospitals (€1.45 billion), medical care centres (€23.90 million), and rehabilitation hospitals (€34.70 million).

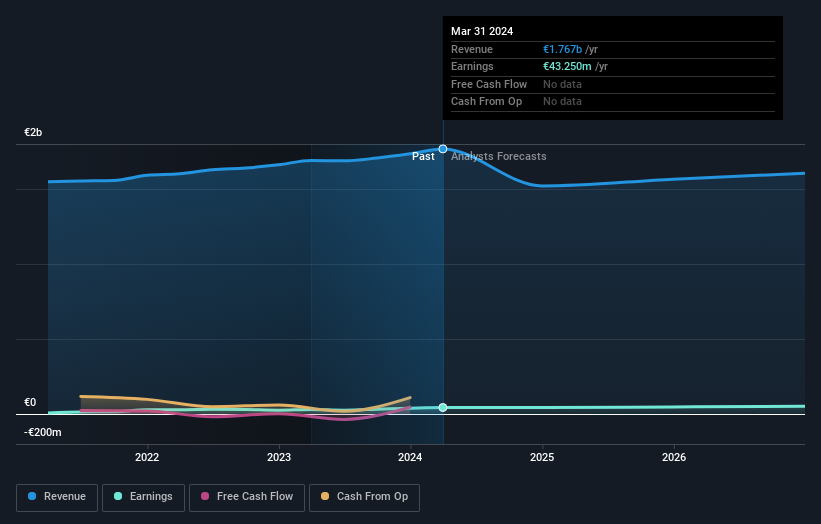

RHÖN-KLINIKUM, a healthcare provider in Germany, reported strong financials for Q2 2024 with sales reaching €392.69M compared to €366.66M the previous year and net income rising to €9.01M from €5.73M. Basic earnings per share improved to €0.14 from €0.09 a year ago, reflecting robust performance in a challenging market environment marked by global crises and regulatory uncertainties. The company's debt-to-equity ratio increased from 8.7% to 11.1% over five years while maintaining high-quality earnings and positive free cash flow.

Navigate through the intricacies of RHÖN-KLINIKUM with our comprehensive health report here.

Explore historical data to track RHÖN-KLINIKUM's performance over time in our Past section.

Next Steps

Investigate our full lineup of 54 German Undiscovered Gems With Strong Fundamentals right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include HMSE:CE2 XTRA:EUZ and XTRA:RHK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com