Discovering Three Hong Kong Dividend Stocks With Yields Up To 8.3%

As global markets navigate through a mix of economic signals, with Hong Kong's Hang Seng Index recently witnessing a notable rise, investors are keenly watching the performance and potential of dividend stocks in this vibrant financial hub. In light of current market conditions, understanding the stability and yield offered by select Hong Kong dividend stocks can provide valuable insights for those looking to enhance their investment portfolios.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 8.30% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 9.33% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.41% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 9.97% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.02% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.22% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.92% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.66% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.73% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

Click here to see the full list of 86 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

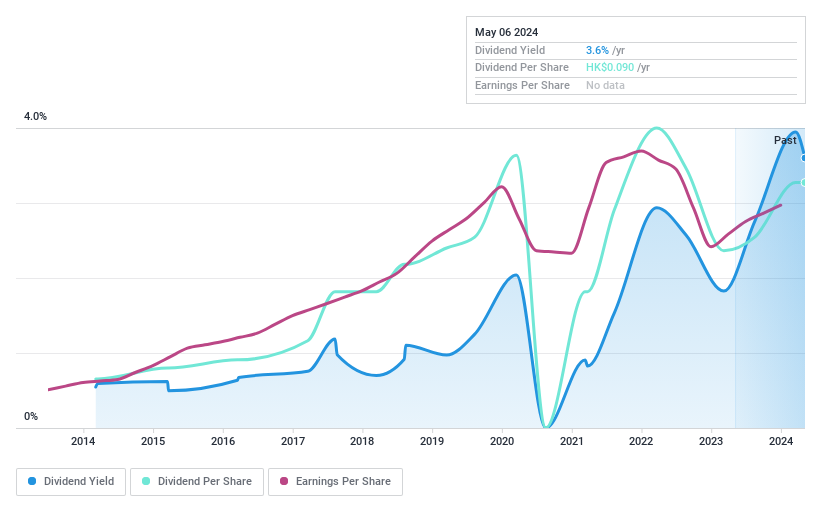

Essex Bio-Technology

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that specializes in developing, manufacturing, distributing, and selling bio-pharmaceutical products across the People’s Republic of China, Hong Kong, and other international markets, with a market capitalization of approximately HK$1.42 billion.

Operations: Essex Bio-Technology generates revenue primarily through its surgical and ophthalmology segments, earning HK$953.16 million and HK$753.39 million respectively.

Dividend Yield: 3.6%

Essex Bio-Technology's recent dividend increase to HK$0.045 per share highlights its commitment to shareholder returns, despite a historically unstable dividend track record over the past decade. The company reported a significant revenue growth to HK$1.71 billion and an increase in net income to HK$275.26 million for FY 2023, supporting a sustainable dividend with low payout ratios of 18.6% against earnings and 24.2% against cash flows. However, its yield of 3.6% remains below the Hong Kong market's top quartile average of 7.82%.

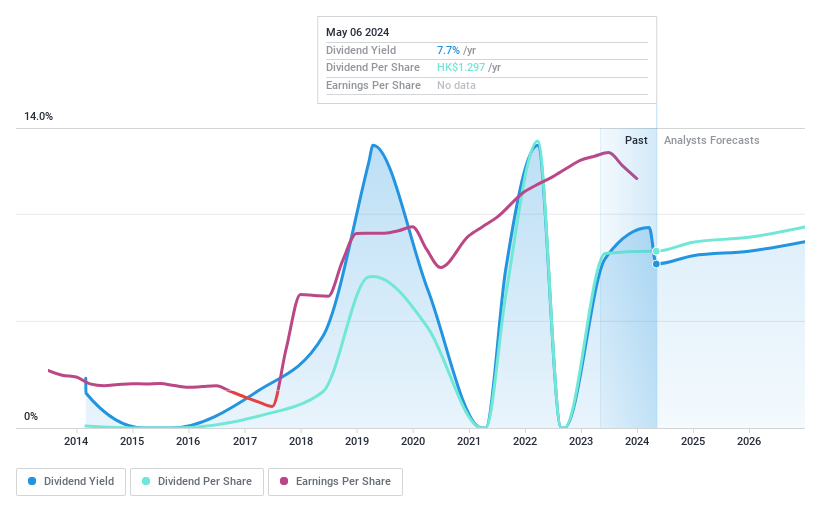

C&D International Investment Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: C&D International Investment Group Limited operates as an investment holding company, focusing on property development, real estate industry chain investment services, and industry investment in Mainland China, Hong Kong, Macau, Taiwan, and internationally with a market capitalization of HK$32.11 billion.

Operations: C&D International Investment Group Limited generates CN¥134.43 billion from its property development segment.

Dividend Yield: 7.7%

C&D International Investment Group proposed a final dividend of HK$1.3 per share for 2023, payable on July 8, 2024, reflecting a commitment to shareholder returns despite recent challenges. The company's dividends are well-covered by earnings and cash flows, with a payout ratio of 45.2% and a cash payout ratio of 9.3%. However, C&D reported a significant year-on-year decrease in contracted sales and floor area by approximately 32.9% and 36.9%, respectively, for Q1 2024 which could pressure future dividends if the trend continues.

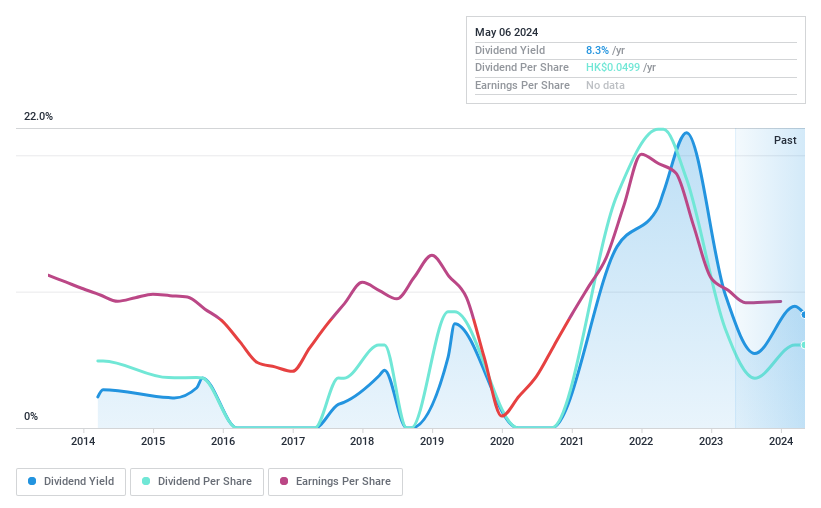

Singamas Container Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Singamas Container Holdings Limited is an investment holding company that specializes in manufacturing and selling containers and related products, with a market capitalization of approximately HK$1.43 billion.

Operations: Singamas Container Holdings Limited generates revenue primarily through two segments: Logistics Services, which brought in HK$27.49 million, and Manufacturing and Leasing, accounting for HK$354.98 million.

Dividend Yield: 8.3%

Singamas Container Holdings proposed a final dividend of HK$0.04 per share for 2023, payable on July 19, 2024, despite a significant drop in sales to US$382.47 million and net income to US$19.44 million from the previous year. The company's dividend history shows volatility and an unreliable pattern over the past decade, with its current payout ratio at 78.5% suggesting dividends are covered by earnings but raising concerns about sustainability given the financial downturn and lack of data on coverage by cash flows.

Next Steps

Discover the full array of 86 Top Dividend Stocks right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1061 SEHK:1908 and SEHK:716.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance