DISH Network's (NASDAQ:DISH) Stock Price Has Reduced 45% In The Past Five Years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term DISH Network Corporation (NASDAQ:DISH) shareholders for doubting their decision to hold, with the stock down 45% over a half decade. It's up 3.6% in the last seven days.

Check out our latest analysis for DISH Network

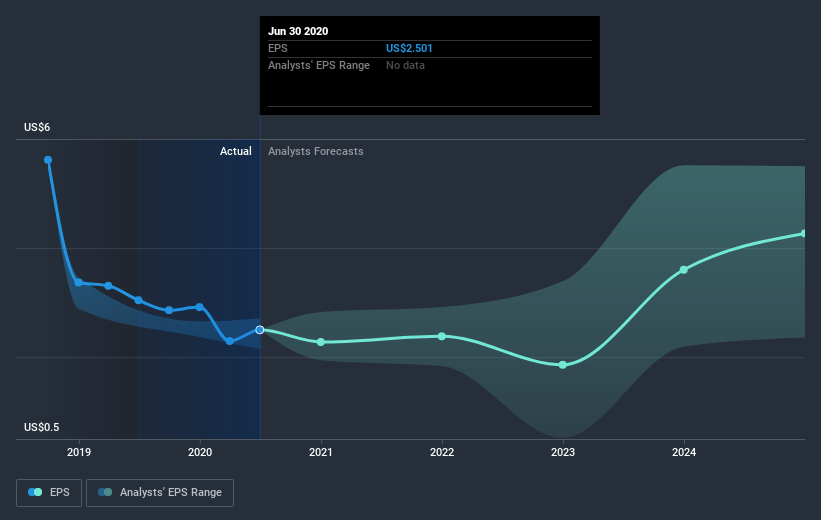

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Looking back five years, both DISH Network's share price and EPS declined; the latter at a rate of 1.3% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 11% per year, over the period. This implies that the market is more cautious about the business these days.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on DISH Network's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

DISH Network shareholders are down 6.2% for the year, but the market itself is up 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 7.6% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that DISH Network is showing 3 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance