The single glimmer of hope in the dismal jobs report may be a false hope: Morning Brief

Monday, May 11, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Many of those ‘temporary’ layoffs will become ‘permanent’

The sharp drop in economic activity was a choice made to contain the spread of the coronavirus.

And millions of those who lost jobs in April are expecting to return after this temporary pause.

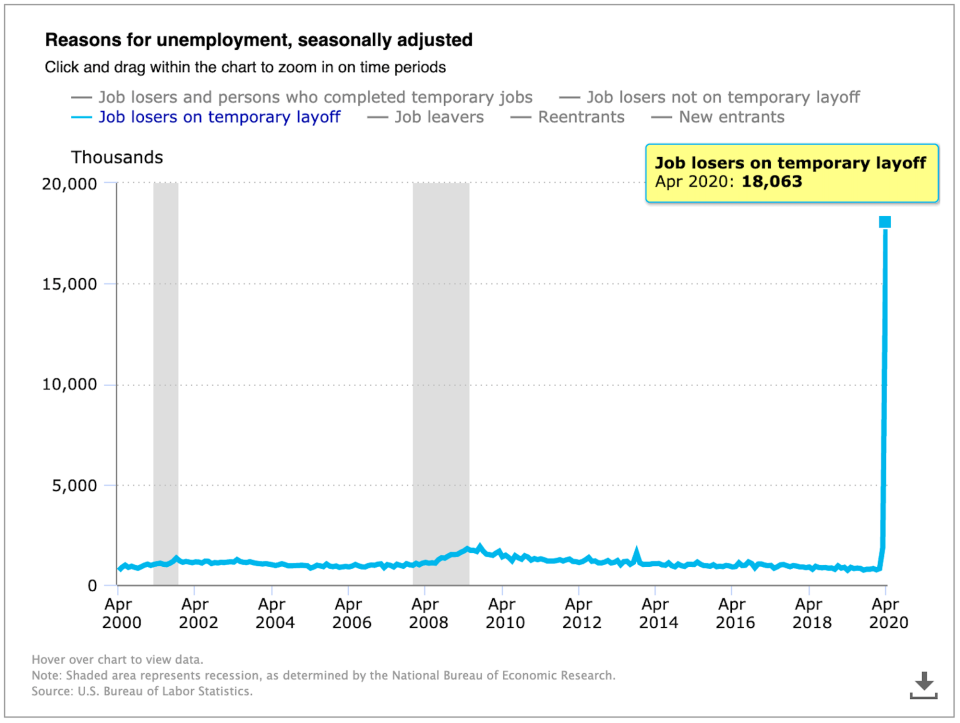

In the BLS’s monthly employment report on Friday — which showed that nonfarm payrolls fell by 20.5 million in April and the unemployment rate spiked to 14.7% (or perhaps 20%) — we learned the number of Americans who were characterized as being “on temporary layoff” was 18.1 million in April, up from 1.8 million in March and just 801,000 in February. That compares to the 2 million “permanent job losers.”

“In a normal recession, nearly all the unemployed are permanent job losers,” Capital Economics’ Paul Ashworth wrote on Friday.

But this economic hard stop was not normal, as it was not characterized by excesses and imbalances. It’s been a forced pause in what was an otherwise solid economic expansion.

“The increase in unemployment is skewed heavily toward persons reporting being on temporary layoff while the number of permanent job losers was relatively more modest,” Goldman Sachs economists wrote. “While the labor market outlook is particularly uncertain this time around, the three post-war recessions with the highest share of temporary layoffs were followed by the fastest labor market recoveries.”

This is encouraging.

The more people that quickly return to work, the more people there will be earning paychecks, and the more people who will spend and send that money back into the economy.

And economists everywhere were quick to point this stat out.

Ashworth called it “the good news.”

Wells Fargo called it “a reason to be optimistic.”

Credit Suisse’s James Sweeney called it “one bright spot.”

Deutsche Bank’s Matthew Luzzetti called it “the silver lining.”

Barclays’ Jonathan Millar also called it “a silver lining.”

Bank of America called it both “the silver lining” and a “glimmer of hope.”

UBS’s Seth Carpenter was a bit more hedged, calling it “a potential upside.”

JPMorgan’s Michael Feroli was even more cautious, saying: “One might take some hope... though BLS so classified anyone [as being on ‘temporary layoff’] who said they did not work ‘because of the coronavirus. Thus it is unclear if these people actually will have jobs to return to when the economy reopens.“

MUFG’s Chris Rupkey also pointed to that skew, and he went even further with his skepticism toward the temporary layoffs.

“I didn’t take any comfort” in this data, Rupkey said Friday on Yahoo Finance’s The Final Round. “The big difference is that companies don’t have to pay any severance [to workers on temporary layoff or furlough] and companies right now are cash strapped. They may not want to pay severance.“

Rupkey also suggested that companies announcing “temporary” layoffs over “permanent” ones may have also been swayed by the PR and morale benefits that such a decision sends, even though it is just putting off the inevitable.

“They haven’t made a decision to fire workers permanently,” he added. “Companies are more patriotic, if you will, in this fight against the pandemic virus than they would be in a normal recession. No, you can’t take much comfort from that.”

And indeed, most of Rupkey’s peers acknowledge that temporary layoffs aren’t a sure thing to remain as much and stressed that timing will play a role.

“If mobility restrictions end soon and the economy recovers, these facts [regarding temporary layoffs] augur for less friction,” UBS’s Carpenter said.

In other words, the labor market remains in a fragile state.

“While low so far, the share of permanent layoffs will rise over time if the economy does not recover,” Goldman Sachs economists said. “Already, anecdotal press reports note that some initially temporary layoffs have become permanent.”

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Earnings

Pre-market

6:15 a.m. ET: Marriott (MAR) is expected to report earnings of 90 cents per share on $4.25 billion in revenue

6:55 a.m. ET: Under Armour (UAA) is expected to report a loss of 19 cents per share on $961.78 million in revenue

Other notable reports: AutoNation (AN), Mylan (MYL), Coty (COTY)

Post-market

Top News

Saudi Arabia triples VAT to pay for pandemic response [Yahoo Finance UK]

Chinese investment in U.S. drops, pandemic to weigh on this year's bilateral flows: report [Reuters]

Aramco seeks to restructure $69.1 billion Sabic deal [Bloomberg]

Musk foils Tesla claim it’s handled COVID-19 like everybody else [Bloomberg]

YAHOO FINANCE HIGHLIGHTS

Trump administration held 'very good' talks with NYSE amid coronavirus: NYSE President

Millions of unbanked Americans face longer wait for CARES Act checks

Student loan startup offers free assistance to borrowers amid the coronavirus pandemic

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance