Dissecting Retail Earnings and Shifting Consumer Spending Trends

It is no surprise that the combined weight of elevated inflation, rising interest rates, and uncertainty about the economy has forced consumers to change their spending behavior.

The issue has undoubtedly been at play with lower-income households for some time now. But we can intuitively appreciate that it will not stay restricted to this consumer segment alone and will most likely move up the income chain in the days ahead.

We saw some of that in the Walmart WMT report that showed the retailer benefiting from higher-income consumers ‘trading down’ to its stores and digital offerings in response to the aforementioned headwinds. The expected continuation of this same trend is also at the root of management’s upgraded guidance for the year.

Another trend at play is the shift in consumer preference for ‘wants’ instead of ‘needs.’ Given the macroeconomic clouds, it makes intuitive sense that consumers will rationally shift away from discretionary spending categories without curbing their demand for essentials. Walmart is better positioned than Target TGT for such an environment, given its significantly bigger grocery business.

However, we should keep in mind that consumers aren’t moving away from all discretionary categories as they continue to spend on leisure, hospitality, and travel services. Consumers spent heavily on discretionary ‘goods’ during Covid and seem to be in no hurry to replace them. But they seem to be making up for missing out on the ‘experiential’ discretionary services of the type mentioned above.

Some of this is likely tied to income distributions as well, with lower-income consumers restricting their spending to their needs and pulling back on discretionary spending of all types.

An excellent example of this is Friday’s Foot Locker FL bombshell, with the company not only missing estimates but significantly cutting guidance for the year. Foot Locker is heavily exposed to lower-income consumers, and that demographic’s outlook remains uncertain, particularly if the labor market starts losing ground going forward because of macroeconomic factors.

The retail business is a tough and competitive space even in ‘normal’ times, and these are anything but normal times.

They need just the right amount of inventory. Otherwise, they will either lose sales if they don’t have enough merchandise, as was the case earlier in the pandemic, or will need to offer steeper discounts and hurt margins if they have too much of it, as we saw with Walmart WMT and Target TGT last year.

Then there is outright theft, referred to as ‘shrink’ by the retailers. Target estimates that ‘shrink’ will be a $500 million hit to its earnings this year. Most management teams shy away from quantifying the full extent of this problem. But published comments from retail industry professionals suggest that the problem has never been this big.

Retailers also need to ensure they have the correct type of merchandise, as we saw with Target and Walmart having too much patio furniture last Spring that consumers weren’t interested in buying. Keeping stores fully staffed in a tight labor market and ensuring just the right amount of price discounts are some of the other challenges that big-box operators like Walmart, Target, and others face daily.

Both Walmart and Target have done an excellent job on the inventory front, but part of the reason for the Foot Locker guidance cut is the inventory pileup. What is most intriguing concerning Foot Locker is that they failed to see any of this during their March 2023 update.

It all comes down to execution and management effectiveness.

In a backdrop of moderating and shifting consumer spending behavior, some retailers have been more successful than others. Walmart has been better, Target less so.

You can see this in the one-year performance of Walmart (blue line, up +26.2%) and Target (red line, down -0.8%) relative to the S&P 500 index (green line, up +8%). We added Foot Locker (orange line, down -2.3%) to the mix to show the stock’s dramatic fall after the aforementioned earnings disappointment.

Image Source: Zacks Investment Research

With respect to the Retail sector 2023 Q1 earnings season scorecard, we now have results from 26 of the 33 retailers in the S&P 500 index. Regular readers know that Zacks has a dedicated stand-alone economic sector for the retail space, which is unlike the placement of the space in the Consumer Staples and Consumer Discretionary sectors in the Standard & Poor’s official industry classification.

The Zacks Retail sector includes not only Walmart, Target, and other traditional retailers but also online vendors like Amazon and restaurant players. The 26 Zacks Retail companies in the S&P 500 index that have reported Q1 results already include the e-commerce and restaurant industries.

Total Q1 earnings for these 26 retailers that have reported are up +6.2% from the same period last year on +6.6% higher revenues, with 84.6% beating EPS estimates and 65.4% beating revenue estimates.

The comparison charts below put the Q1 beats percentages for these retailers in a historical context.

Image Source: Zacks Investment Research

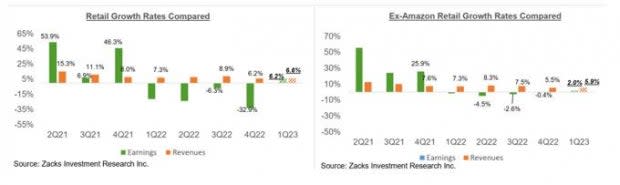

With respect to the earnings and revenue growth rates, we like to show the group’s performance with and without Amazon, whose results are among the 26 companies that have reported already. As we know, Amazon’s Q1 earnings were up +46.8% on +9.4% higher revenues, as it beat top and bottom-line expectations.

As we all know, the digital and brick-and-mortar operators have been converging for some time now. Amazon is now a decent-sized brick-and-mortar operator after Whole Foods, and Walmart is a growing online vendor. This long-standing trend got a huge boost from the Covid lockdowns.

The two comparison charts below show the Q1 earnings and revenue growth relative to other recent periods, both with Amazon’s results (left side chart) and without Amazon’s numbers (right side chart)

Image Source: Zacks Investment Research

Q1 Earnings Season Scorecard

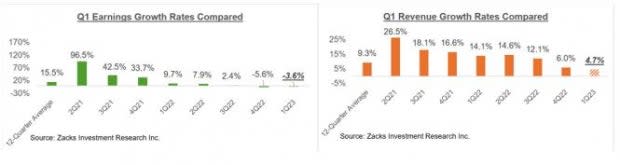

Including all the quarterly reports that came out through Friday, May 19th, we now have Q1 earnings from 473 S&P 500 members, or 94.6% of the index’s total membership. Total earnings for these companies are down -3.6% from the same period last year on +4.7% higher revenues, with 78% beating EPS estimates and 74.8% beating revenue estimates.

The proportion of these companies beating both EPS and revenue estimates is 63%.

Regular readers of our earnings commentary know that we have been referring to the overall picture emerging from the Q1 earnings season as good enough; not great, but not bad either.

With this reporting cycle now largely behind us, we can confidently say that corporate earnings aren’t headed towards the ‘cliff’ that market bears were warning us of.

The way we see it, the ‘better-than-feared’ view of the Q1 earnings season at this stage may be a bit unfair, given how resilient corporate profitability has turned out to be. But the view isn’t entirely off the mark either.

We have about 150 companies on deck to report results, including 15 S&P 500 members. This week’s docket includes Lowe’s, Nvidia, Best Buy, Ralph Lauren, Dicks Sporting Goods, and others.

Below, we compare the Q1 results thus far from what we have seen from this same group of 459 index members in other recent periods.

The first set of charts compares the earnings and revenue growth rates for the companies that have reported with what we had seen from the group in other recent quarters.

Image Source: Zacks Investment Research

The comparison charts below put the Q1 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

The Earnings Big Picture

To get a sense of what is currently expected, take a look at the chart below that shows current earnings and revenue growth expectations for the S&P 500 index for 2023 Q1 and the following three quarters.

Image Source: Zacks Investment Research

As you can see here, 2023 Q1 earnings are expected to be down -3.8% on +4.4% higher revenues. This would follow the -5.4% earnings decline in the preceding period (2022 Q4) on +5.9% higher revenues.

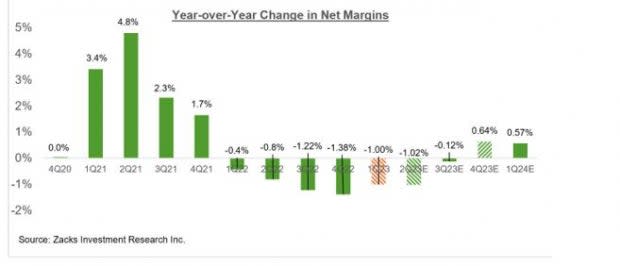

We get to down earnings on positive revenues when margins are squeezed. That’s what we have been witnessing in the ongoing earnings season, which is in-line with the trend we have been seeing for some time now. In fact, 2023 Q1 is the 5th quarter in a row of declining margins.

The chart below shows the year-over-year change in net income margins for the S&P 500 index.

Image Source: Zacks Investment Research

Actual results provide a lot better on this front relative to what was expected ahead of the releases, with the outperformance particularly notable for the Tech sector.

The chart below shows the earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

One notable recent development on the earnings front, which we have been flagging in recent weeks, is the reversal on the revisions front, with full-year 2023 earnings starting to go up since the start of April. This comes after almost a year of steady declines in full-year 2023 earnings, which peaked in April 2022.

Since the start of 2023 Q2, aggregate bottom-up S&P 500 earnings are flat or unchanged as a whole and +0.4%, excluding the Energy sector, whose estimates have been coming down. In fact, estimates for 8 of the 16 Zacks sectors are up since the start of Q2, with notable increases in the Construction, Industrial Products, Autos, Retail, and Tech sectors. On the negative side, estimates are coming down for the Energy, Basic Materials, Aerospace, and Transportation sectors.

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>Decoding Recent Positive Earnings Estimate Revisions

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Foot Locker, Inc. (FL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance