You Should Diversify With These Cyclical Dividend Stocks

The performance of consumer cyclical companies is heavily dependent on the economic cycle. Businesses such as Cato and American Eagle Outfitters offer products that are considered luxury items, rather than those of absolute necessity, for example gambling and day spas. This means, during times of an economic boom, consumers have a bit more income to splurge on a new TV, which increases the profitability of these businesses. This tends to lead to higher cash flows and hefty dividend income for an investors’ portfolio. If you’re a buy-and-hold investor, these healthy dividend stocks in the consumer cyclical industry can generously contribute to your monthly portfolio income.

The Cato Corporation (NYSE:CATO)

CATO has a enticing dividend yield of 5.46% with a high payout ratio . In the case of CATO, they have increased their dividend per share from US$0.66 to US$1.32 so in the past 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. With zero debt, I’m optimistic on the company’s health if a downturn occurs in the future. Interested in Cato? Find out more here.

American Eagle Outfitters, Inc. (NYSE:AEO)

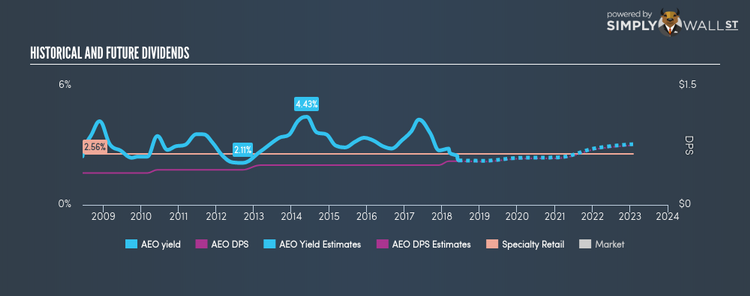

AEO has a sizeable dividend yield of 2.24% and has a payout ratio of 41.52% . The company’s dividends per share have risen from US$0.40 to US$0.55 over the last 10 years. The company has been a dependable payer too, not missing a payment in this 10 year period. More detail on American Eagle Outfitters here.

Penske Automotive Group, Inc. (NYSE:PAG)

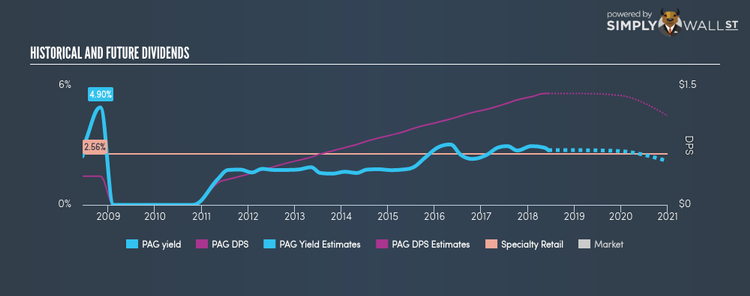

PAG has a sizeable dividend yield of 2.75% and the company has a payout ratio of 18.05% , and analysts are expecting the payout ratio in three years to hit 24.26%. While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. Penske Automotive Group’s earnings growth over the past 12 months has exceeded the us specialty retail industry, with the company reporting an EPS growth of 83.53% while the industry totaled 6.68%. Dig deeper into Penske Automotive Group here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance