The Dividend Dilemma: Steering Clear of Corby Spirit and Wine and Spotlighting One Superior Stock Pick

Dividend-paying stocks are often sought after for their potential to provide investors with a steady stream of income. However, high payout ratios, such as those seen with Corby Spirit and Wine, raise important questions about the sustainability of these dividends. In this context, understanding the balance between attractive yields and financial health is crucial for investors looking to make informed decisions.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

IGM Financial (TSX:IGM) | 6.58% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.92% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.47% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.96% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 3.88% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.00% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 3.73% | ★★★★★☆ |

Goodfellow (TSX:GDL) | 6.97% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.64% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.41% | ★★★★★☆ |

Click here to see the full list of 40 stocks from our Top Dividend Stocks screener.

Let's review one of the notable picks from our screened stocks and one not so great.

One To Reconsider

Corby Spirit and Wine (TSX:CSW.A)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Corby Spirit and Wine Limited operates in the manufacturing, marketing, and importing of spirits and wines across Canada, the United States, the United Kingdom, and other international markets with a market cap of approximately CA$379.05 million.

Operations: The company generates its revenue primarily through Case Goods, contributing CA$161.93 million, and is supplemented by Commissions (Net of Amortization) at CA$25.61 million and Other Services at CA$3.59 million.

Dividend Yield: 6.2%

Corby Spirit and Wine's recent financial performance shows a decline in net income from CAD 8.56 million to CAD 7.31 million in Q2, with a year-over-year sales increase to CAD 56.03 million. Despite maintaining a consistent dividend payout of $0.21 per share, analysis highlights concerns: earnings have decreased by an average of 4.7% annually over the past five years, indicating challenges in growth sustainability. The company's high level of debt and a dividend yield (6.22%) slightly below the top Canadian dividend payers raise flags about its financial health and the sustainability of its dividends, further exacerbated by an unsustainable payout ratio (117.3%). These factors suggest caution for dividend-focused investors considering Corby Spirit and Wine as an attractive option.

Top Pick

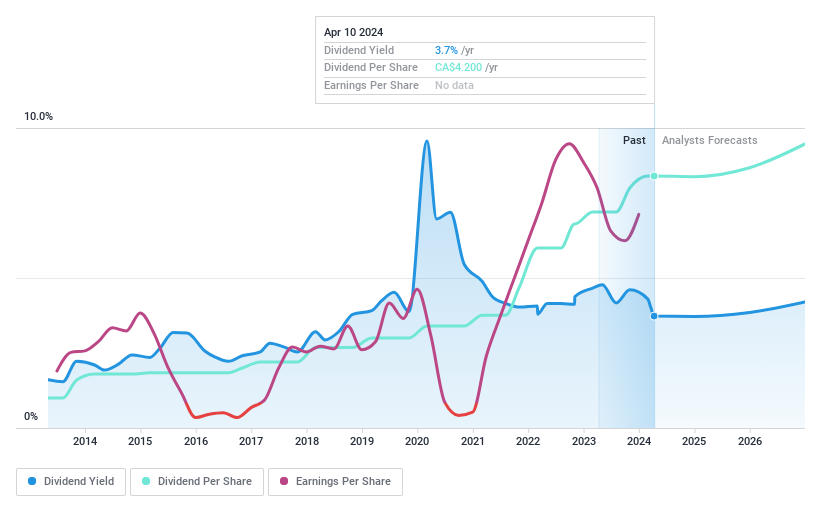

Canadian Natural Resources (TSX:CNQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The company is a major player in the energy sector, focusing on the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs), with a market capitalization of approximately CA$118.99 billion.

Operations: The company generates its revenue from various segments, including Midstream and Refining (CA$1.00 billion), Oil Sands Mining and Upgrading (CA$16.30 billion), Exploration and Production in the North Sea (CA$0.44 billion), North America (CA$17.32 billion), and Offshore Africa (CA$0.58 billion).

Dividend Yield: 3.7%

Canadian Natural Resources stands out for its stable and growing dividends, underscored by a 10-year history of reliability and growth. The company's dividend yield is at 3.73%, with dividends well-covered by both earnings (49% payout ratio) and cash flows (60.5% cash payout ratio), indicating sustainability. Despite trading below fair value, offering good value to investors, its dividend yield is lower than the top quartile in the Canadian market (6.39%). Recent strategic moves include a share split proposal and an aggressive share repurchase program, signaling confidence in its financial health. However, a slight dip in annual revenue and net income highlights areas for cautious observation amidst overall positive indicators for dividend investors.

Key Takeaways

Investigate our full lineup of 40 Top Dividend Stocks right here.

Have a stake in one of these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance