Dividends Set for Worst Year Since 2009

Investors worldwide lost more than $100 billion in dividend payments in the last quarter, according to a survey by Janus Henderson, and this year is set to be the worst year for income seekers since the financial crisis.

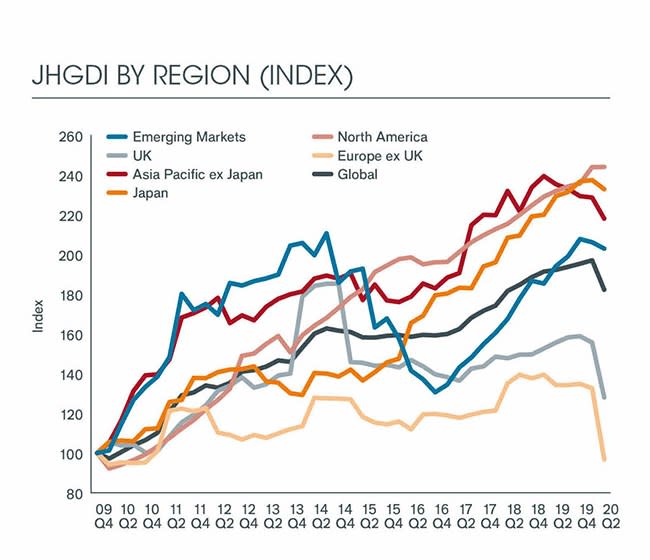

The asset manager says that in the second quarter, at the height of the market volatility caused by the pandemic, total payouts fell by $108 billion to $382 billion, the worst quarterly drop since 2009 when the Global Dividend Index started.

But the difference between regions was stark: while UK dividends more than halved in Q2 compared with the same period of 2019, North American payouts were marginally higher in those three months, helped by the resilience of Canadian companies’ dividends. Japan (down 4.2% on the year) and emerging markets (-5.9%) were among the least affected regions.

As a region, Europe wasn’t too far behind the UK, with a near 45% drop in the second quarter, but there was a wide difference between countries on the continent. Swiss company payouts were resilient, whereas French investors faced the worst payout levels in more than a decade. European companies generally pay investors once a year in the second quarter and with so many cutting or scrapping dividends this year, comparisons with 2019 are bound to look dire.

There was also a wide disparity in dividend cuts across the sectors. Healthcare and communications companies actually increased their payouts in the period, while the financial sector was hit hard by payout bans in Europe and the UK. Companies most exposed to lockdown measures such as consumer discretionary stocks naturally fared the worst financially, and made the deepest cuts.

The Janus Henderson report also reveals the impact of a fall in special dividends in Q2 as companies cut back on non-essential payouts this year.

Lower Yields for Longer

Morningstar’s monthly list of quality dividends shows investors adjusting to lower yields as the impact of dividend cuts takes effect. Wide-moat GlaxoSmithKline, with a forecast yield of under 5%, is currently top of the list, but its dividend cover is less than some of its income-paying peers. Most of the biggest UK equity income funds have a yield of less than 5% too, our recent analysis has found.

Overall, Janus Henderson expects a fall of just under 20% for global dividends this year to around $1 trillion, and in a worst-case scenario the fall could be as much as 25%. Still, the outlook for the whole year is not as bad as expected three months ago when Janus Henderson predicted a 35% fall in global dividends. Jane Shoemake, investment director of global equity income, says there are reasons to be optimistic as many dividends that were deferred during the market panic have been paid in recent months. But there is still a question mark hanging over US and Canadian payouts. While the North American region has so far been resilient, the fourth quarter could be a crunch time as companies usually reset dividends for the following year.

She adds that the regional differences underlines the importance of a global approach to income investing: “A temporary halt in dividends does not change the fundamental value of a company, though it can affect short-term sentiment, and it remains important for income investors to be diversified both by geography and sector”.

Overseas income funds that are highly rated by Morningstar include JPM US Equity Income, which has a Gold Analyst Rating, and Silver-rated Fidelity Global Dividend.

Yahoo Finance

Yahoo Finance