Does 1Spatial (LON:SPA) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like 1Spatial (LON:SPA), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for 1Spatial

1Spatial's Improving Profits

1Spatial has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. 1Spatial boosted its trailing twelve month EPS from UK£0.0095 to UK£0.011, in the last year. That's a 11% gain; respectable growth in the broader scheme of things.

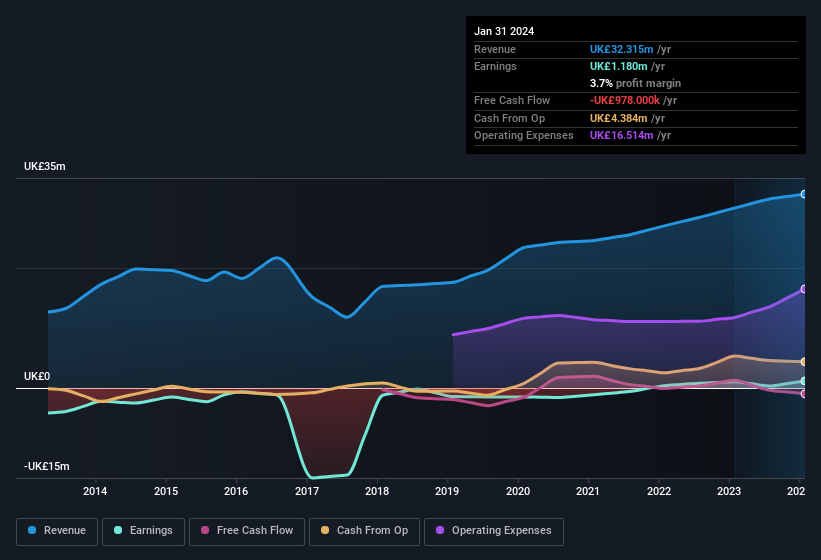

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note 1Spatial achieved similar EBIT margins to last year, revenue grew by a solid 7.7% to UK£32m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of 1Spatial's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are 1Spatial Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that 1Spatial insiders spent UK£50k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. We also note that it was the CEO & Director, Claire Milverton-Clark, who made the biggest single acquisition, paying UK£40k for shares at about UK£0.48 each.

Is 1Spatial Worth Keeping An Eye On?

One important encouraging feature of 1Spatial is that it is growing profits. Not every business can grow its EPS, but 1Spatial certainly can. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. Before you take the next step you should know about the 1 warning sign for 1Spatial that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, 1Spatial isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance