Does Air Transport Services Group's (NASDAQ:ATSG) Share Price Gain of 93% Match Its Business Performance?

If you buy and hold a stock for many years, you'd hope to be making a profit. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Air Transport Services Group, Inc. (NASDAQ:ATSG) share price is up 93% in the last five years, that's less than the market return. However, more recent buyers should be happy with the increase of 29% over the last year.

See our latest analysis for Air Transport Services Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Air Transport Services Group's earnings per share are down 7.0% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 18% per year is probably viewed as evidence that Air Transport Services Group is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

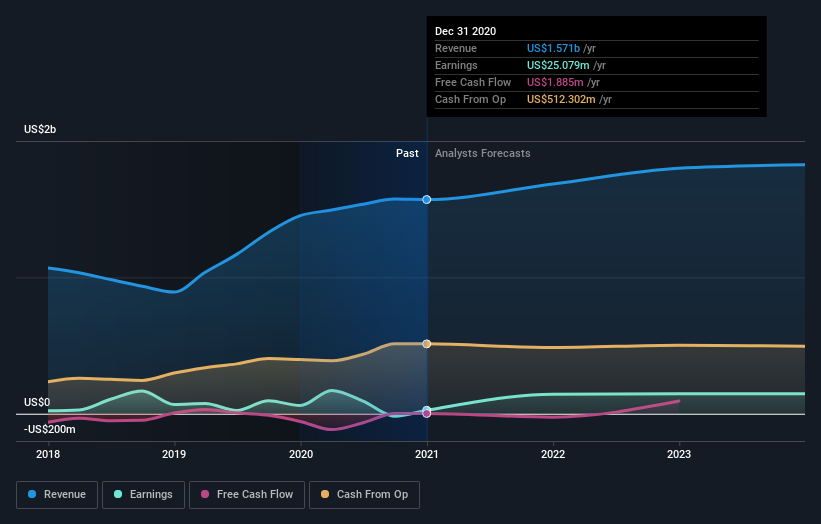

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Air Transport Services Group shareholders gained a total return of 29% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 14% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand Air Transport Services Group better, we need to consider many other factors. For example, we've discovered 4 warning signs for Air Transport Services Group that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance