Does Arena Events Group (LON:ARE) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Arena Events Group plc (LON:ARE) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Arena Events Group

What Is Arena Events Group's Net Debt?

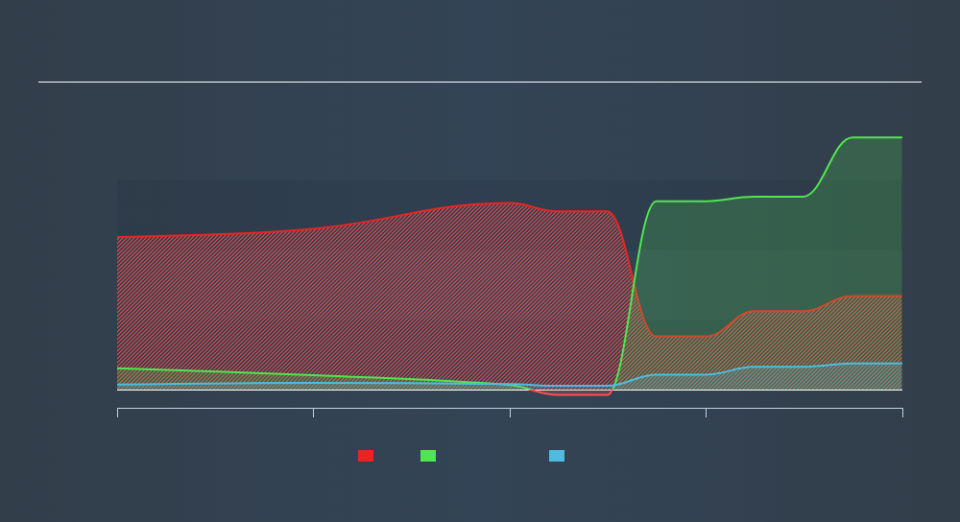

As you can see below, at the end of December 2018, Arena Events Group had UK£26.7m of debt, up from UK£16.7m a year ago. Click the image for more detail. However, it also had UK£7.50m in cash, and so its net debt is UK£19.2m.

How Healthy Is Arena Events Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Arena Events Group had liabilities of UK£39.1m due within 12 months and liabilities of UK£35.7m due beyond that. Offsetting this, it had UK£7.50m in cash and UK£21.3m in receivables that were due within 12 months. So its liabilities total UK£46.0m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of UK£43.3m, we think shareholders really should watch Arena Events Group's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Arena Events Group's debt to EBITDA ratio (2.5) suggests that it uses some debt, its interest cover is very weak, at 1.3, suggesting high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Shareholders should be aware that Arena Events Group's EBIT was down 57% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Arena Events Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Arena Events Group saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Arena Events Group's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. Taking into account all the aforementioned factors, it looks like Arena Events Group has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Even though Arena Events Group lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check outhow earnings have been trending over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance