Does Audax Renovables (BME:ADX) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Audax Renovables, S.A. (BME:ADX) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Audax Renovables

What Is Audax Renovables's Net Debt?

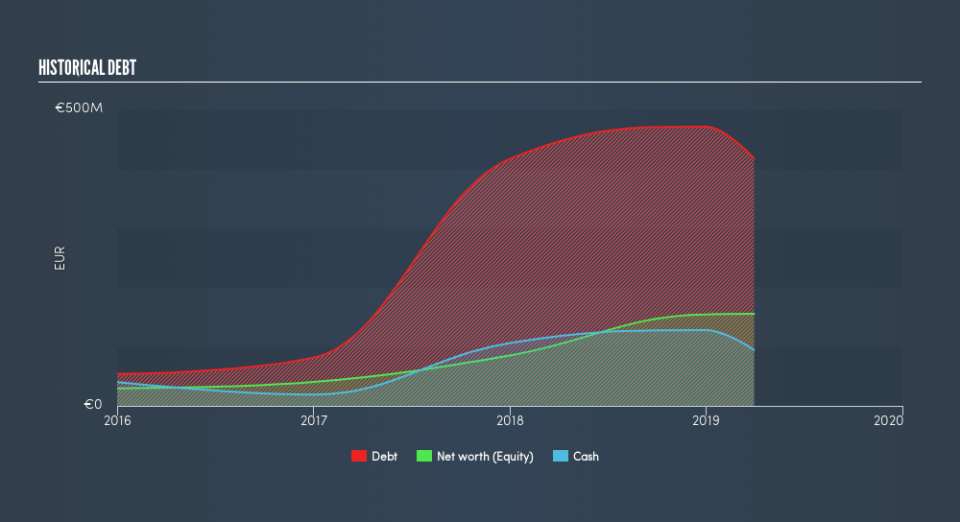

The chart below, which you can click on for greater detail, shows that Audax Renovables had €417.4m in debt in March 2019; about the same as the year before. However, because it has a cash reserve of €94.3m, its net debt is less, at about €323.1m.

A Look At Audax Renovables's Liabilities

Zooming in on the latest balance sheet data, we can see that Audax Renovables had liabilities of €366.2m due within 12 months and liabilities of €305.3m due beyond that. Offsetting these obligations, it had cash of €94.3m as well as receivables valued at €154.8m due within 12 months. So its liabilities total €422.5m more than the combination of its cash and short-term receivables.

Audax Renovables has a market capitalization of €805.7m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 1.5 times and a disturbingly high net debt to EBITDA ratio of 6.3 hit our confidence in Audax Renovables like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Looking on the bright side, Audax Renovables boosted its EBIT by a silky 32% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. There's no doubt that we learn most about debt from the balance sheet. But it is Audax Renovables's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Audax Renovables recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On the face of it, Audax Renovables's interest cover left us tentative about the stock, and its net debt to EBITDA was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at growing its EBIT; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Audax Renovables stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. Over time, share prices tend to follow earnings per share, so if you're interested in Audax Renovables, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance