Does Bushveld Minerals (LON:BMN) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Bushveld Minerals (LON:BMN). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Bushveld Minerals

Bushveld Minerals's Improving Profits

Over the last three years, Bushveld Minerals has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Bushveld Minerals's EPS shot from US$0.017 to US$0.033, over the last year. You don't see 96% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

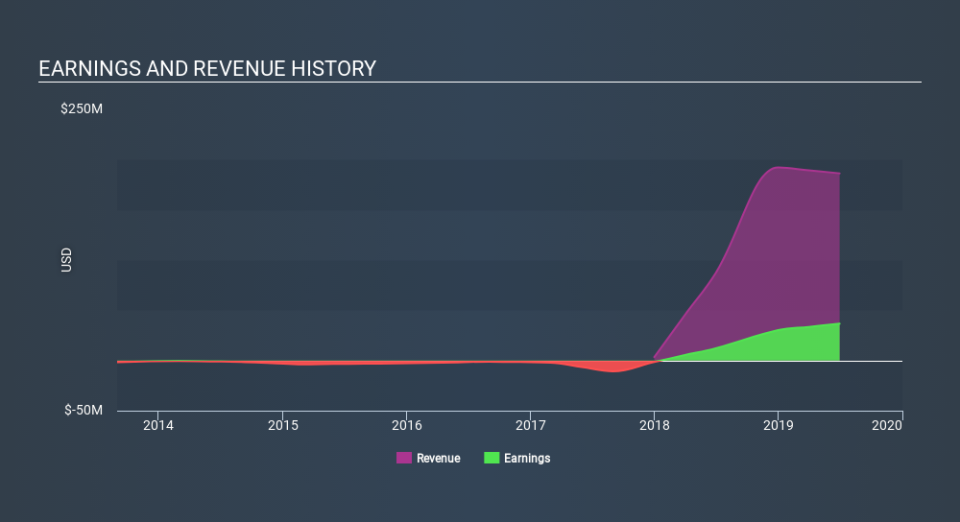

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Bushveld Minerals is growing revenues, and EBIT margins improved by 3.0 percentage points to 48%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Bushveld Minerals?

Are Bushveld Minerals Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Bushveld Minerals insiders have a significant amount of capital invested in the stock. Indeed, they hold US$9.8m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 6.5% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Bushveld Minerals Deserve A Spot On Your Watchlist?

Bushveld Minerals's earnings have taken off like any random crypto-currency did, back in 2017. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Bushveld Minerals for a spot on your watchlist. Even so, be aware that Bushveld Minerals is showing 3 warning signs in our investment analysis , and 1 of those is concerning...

Although Bushveld Minerals certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance