Does Coastal Financial (NASDAQ:CCB) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Coastal Financial (NASDAQ:CCB). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Coastal Financial

How Fast Is Coastal Financial Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Impressively, Coastal Financial has grown EPS by 30% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

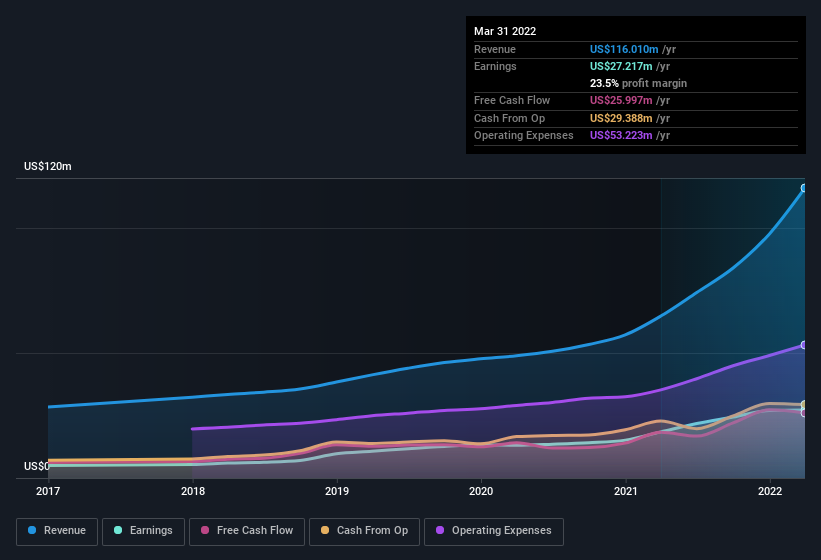

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Coastal Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Coastal Financial's EBIT margins were flat over the last year, revenue grew by a solid 79% to US$116m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Coastal Financial's future profits.

Are Coastal Financial Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Although we did see some insider selling (worth -US$497k) this was overshadowed by a mountain of buying, totalling US$1.5m in just one year. I find this encouraging because it suggests they are optimistic about the Coastal Financial's future. Zooming in, we can see that the biggest insider purchase was by Vice Chairman Andrew Skotdal for US$1m worth of shares, at about US$40.50 per share.

The good news, alongside the insider buying, for Coastal Financial bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping US$92m worth of shares as a group, insiders have plenty riding on the company's success. At 18% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

Should You Add Coastal Financial To Your Watchlist?

You can't deny that Coastal Financial has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Coastal Financial , and understanding it should be part of your investment process.

The good news is that Coastal Financial is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance