Does EssilorLuxottica Société anonyme's (EPA:EL) CEO Pay Compare Well With Peers?

Hubert Sagnières is the CEO of EssilorLuxottica Société anonyme (EPA:EL). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at other big companies. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for EssilorLuxottica Société anonyme

How Does Hubert Sagnières's Compensation Compare With Similar Sized Companies?

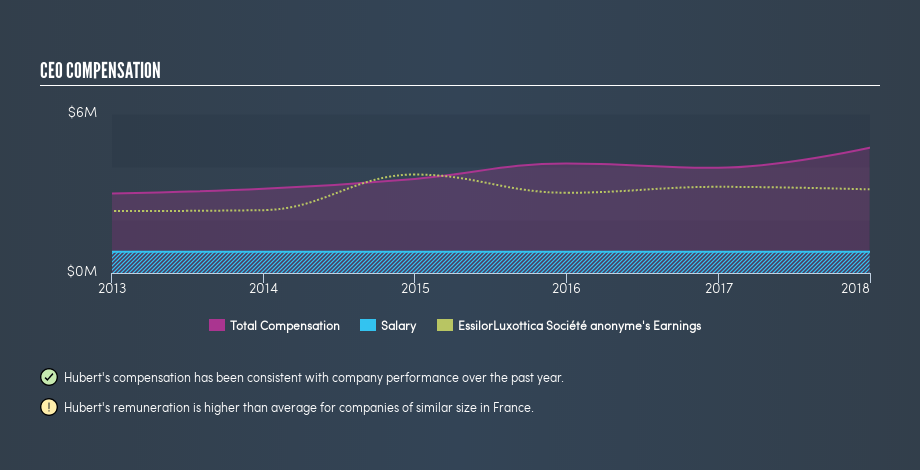

At the time of writing our data says that EssilorLuxottica Société anonyme has a market cap of €44b, and is paying total annual CEO compensation of €4.7m. (This number is for the twelve months until December 2017). While we always look at total compensation first, we note that the salary component is less, at €800k. We took a group of companies with market capitalizations over €7.1b, and calculated the median CEO total compensation to be €2.9m. There aren't very many mega-cap companies, so we had to take a wide range to get a meaningful comparison figure.

Thus we can conclude that Hubert Sagnières receives more in total compensation than the median of a group of large companies in the same market as EssilorLuxottica Société anonyme. However, this doesn't necessarily mean the pay is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance.

You can see, below, how CEO compensation at EssilorLuxottica Société anonyme has changed over time.

Is EssilorLuxottica Société anonyme Growing?

On average over the last three years, EssilorLuxottica Société anonyme has grown earnings per share (EPS) by 1.7% each year (using a line of best fit). In the last year, its revenue is up 44%.

It's great to see that revenue growth is strong. Combined with modest EPS growth, we get a good impression of the company. I'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. You might want to check this free visual report on analyst forecasts for future earnings.

Has EssilorLuxottica Société anonyme Been A Good Investment?

Given the total loss of 3.4% over three years, many shareholders in EssilorLuxottica Société anonyme are probably rather dissatisfied, to say the least. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared total CEO remuneration at EssilorLuxottica Société anonyme with the amount paid at other large companies. As discussed above, we discovered that the company pays more than the median of that group.

While we have not been overly impressed by the business performance, the shareholder returns, over three years, have been disappointing. Although we'd stop short of calling it inappropriate, we think the CEO compensation is probably more on the generous side of things. Shareholders may want to check for free if EssilorLuxottica Société anonyme insiders are buying or selling shares.

Important note: EssilorLuxottica Société anonyme may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance