Does Fastenal (NASDAQ:FAST) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Fastenal (NASDAQ:FAST). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Fastenal

How Quickly Is Fastenal Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Fastenal managed to grow EPS by 8.3% per year, over three years. That's a pretty good rate, if the company can sustain it.

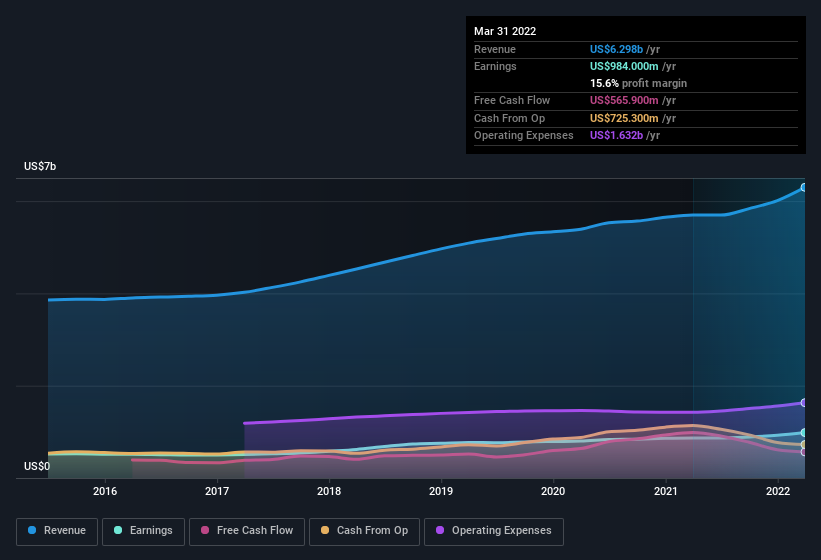

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Fastenal maintained stable EBIT margins over the last year, all while growing revenue 11% to US$6.3b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Fastenal's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Fastenal Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite US$27k worth of sales, Fastenal insiders have overwhelmingly been buying the stock, spending US$525k on purchases in the last twelve months. This overall confidence in the company at current the valuation signals their optimism. It is also worth noting that it was Independent Director Sarah Nielsen who made the biggest single purchase, worth US$56k, paying US$55.76 per share.

The good news, alongside the insider buying, for Fastenal bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth US$103m. While that is a lot of skin in the game, we note this holding only totals to 0.3% of the business, which is a result of the company being so large. This should still be a great incentive for management to maximise shareholder value.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Dan Florness, is paid less than the median for similar sized companies. For companies with market capitalisations over US$8.0b, like Fastenal, the median CEO pay is around US$13m.

The CEO of Fastenal only received US$2.4m in total compensation for the year ending December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Fastenal Deserve A Spot On Your Watchlist?

One positive for Fastenal is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. However, before you get too excited we've discovered 1 warning sign for Fastenal that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Fastenal isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance