Does International Consolidated Airlines Group (LON:IAG) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, International Consolidated Airlines Group, S.A. (LON:IAG) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for International Consolidated Airlines Group

What Is International Consolidated Airlines Group's Debt?

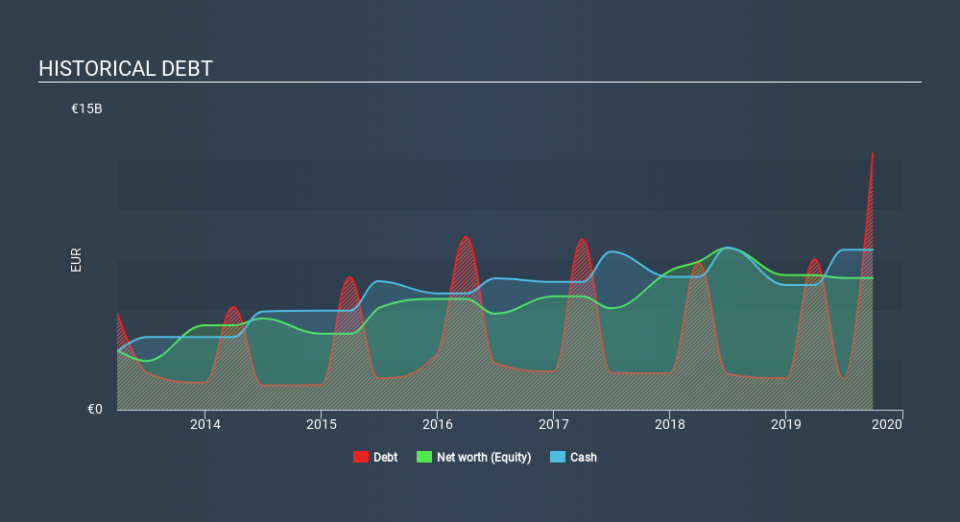

You can click the graphic below for the historical numbers, but it shows that as of June 2019 International Consolidated Airlines Group had €1.56b of debt, an increase on €1.8k, over one year. However, its balance sheet shows it holds €7.99b in cash, so it actually has €6.43b net cash.

A Look At International Consolidated Airlines Group's Liabilities

According to the last reported balance sheet, International Consolidated Airlines Group had liabilities of €14.8b due within 12 months, and liabilities of €14.7b due beyond 12 months. Offsetting this, it had €7.99b in cash and €2.21b in receivables that were due within 12 months. So it has liabilities totalling €19.3b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's huge €15.5b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. International Consolidated Airlines Group boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

But the bad news is that International Consolidated Airlines Group has seen its EBIT plunge 11% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine International Consolidated Airlines Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While International Consolidated Airlines Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, International Consolidated Airlines Group's free cash flow amounted to 34% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While International Consolidated Airlines Group does have more liabilities than liquid assets, it also has net cash of €6.43b. Despite its cash we think that International Consolidated Airlines Group seems to struggle to handle its total liabilities, so we are wary of the stock. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance