What does North Korea's nuclear threat mean for financial markets?

North Korea’s sixth nuclear test might have led to apocalyptic headlines, but global investors appear to still be shrugging of the threat of Kim Jong-un pressing the red button.

While the potential threat of an imminent missile attack sent investors switching out of equities and searching for safe havens in the form of gold and the yen, traders still are betting on a low-chance of nuclear warfare.

The muted reaction from stocks and currencies so far seem at odds with the tense rhetoric between Pyongyang and the US. “It might be a brave assumption, but investors are betting that there will be a rational outcome on all sides rather than the worst possible outcome," explains Richard Dunbar, investment strategist at Aberdeen Standard Investments.

Analysts at Nomura, which last week lowered the chance of war on the Korean peninsula to 35pc from nearly 50pc, said that they still believed the latest provocation from Kim Jong-un was “in line with our base case - that tensions will remain elevated, yet contained for some time”.

Stock markets

In South Korea, where Boris Johnson has warned that the capital Seoul will be "vaporised" by a nuclear threat, the Kospi index fell by nearly 2pc before closing down just 1.19pc, or 28.04 points, to end at 2,329.65 points.

The nation's Kospi 200 Volatility Index - which measures price swings from some of the largest stocks such as Samsung Electronics and Hyundai Motors - jumped 11pc to 14.78, the biggest gain since Aug 11 when Donald Trump warned he would respond to North Korea's nuclear earlier threat with "fire and fury".

"Like a bad horror movie, the North Korea saga intersperses moments of calm, with occasional action to jolt you out of your chair," commented ING's head of Asian research Rob Carnell. "But we have been here now many, many times," he added. "Unless this is the precursor to US military action, which we doubt, then in a little over a day or two, tensions will calm again, making this a good buying opportunity for investors with a strong enough nerve."

The restrained equities reaction to North Korea’s ballistic threats was explained by Mr Dunbar of Aberdeen Standard: “It is a greater worry than it was a week ago but the market believes the risk of a catastrophic outcome is an unlikely one, albeit there is a higher risk than before.”

In Asia, the Nikkei shed 183.22, or 0.93pc, to 19508.25 while Hong Kong’s Hang Seng dipped 212.9, or 0.76pc, to 27740.26.

The FTSE 100 fell 27.03 or 0.36pc, to 7,411.47 while the Dax dropped 40.4, or 0.33pc, to 12,102.21 points in Frankfurt. In Paris the CAC lost 19.29, or 0.38pc, to 5,103.97. Meanwhile, the FTSE 250, which is more representative of investors sentiment about the UK than the blue-chip index, slipped 88.27, or 0.45pc, to 19,697.91.

The US markets were shut yesterday due to Labor Day holidays, meaning that the impact on was limited to US Treasuries.

"The markets’ reaction seems similar to when missile launches have taken place in the past; investors sell stock, rush to safe havens, assess the situation, and then buy the dips as tension eases," says Hussein Sayed, chief market strategist at FXTM. "While stocks fell in Asia, the selloff was not massive, mainly because the nuclear test occurred over the weekend and there was enough time to digest the news."

Currencies

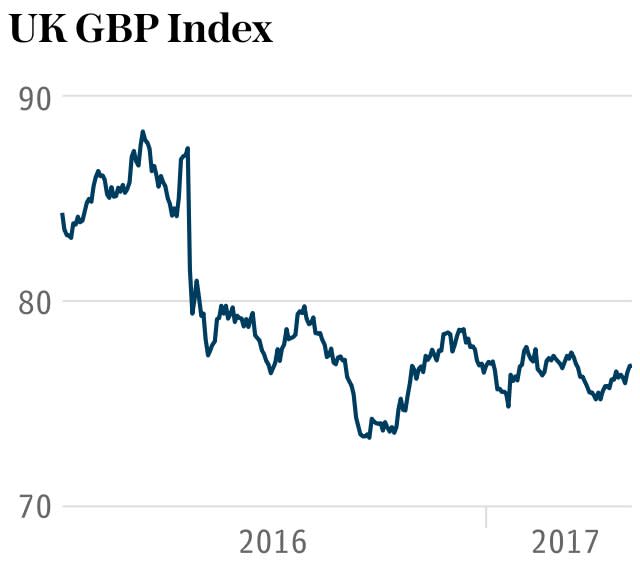

Despite North Korea hailing its hydrogen-bomb test a “perfect success” the pound remained broadly flat at $1.29. The euro was a shade firmer at $1.19 as investors are wary ahead of a European Central Bank meeting later this week.

Meanwhile, the South Korean won also saw its biggest decline against the dollar since March, though the slump eased as the trading day wore on. The currency is still on track for its biggest annual gain since 2012.

Safe Havens

Less-risky assets, such as gold are benefiting once again from the geopolitical tensions, as they have done in past incidents.

Gold rose by as much as 1pc, the highest trading levels since November 2016. Bullion is changing hands at $1,337 per ounce, its highest level for 10 months when Donald Trump's shock election victory rattled markets.

Mike van Dulken of Accendo market said: "Expect North Korean rhetoric to heavily influence the safe haven asset throughout the day as global leaders react to the latest provocations."

The gold price jump has helped to push up precious metals producers Randgold and Fresnillo who defied the wider equities sell-off, both rising by around 2pc.

Meanwhile, the yen gained 0.6pc to 109.48 per dollar after advancing as much as 0.9pc.

Why is Japan's yen still considered a safe haven?

The yen has had mixed reactions to North Korea's previous nuclear tests as investors have had to choose between the currency's safe haven characteristics and Japan's risk of being affected by a missile strike.

"The Japanese yen, another typical safe haven currency is also moving higher, a rather odd choice by traders given its proximity to any potential ground zero," said Fiona Cincotta at City Index.

The yen is the third most traded global currency, but the chief explanation for the yen's attractiveness is largely the size of Japan's foreign assets.

With $1.09 trillion of Treasuries as of June, the nation is the largest overseas holder of overseas assets after China, according to the US government. Investors believe that at times of tension, funds may be repatriated which would spur currency gains.

The yen has a strong historical track record of performing well during times of global risk and is seen to be considered the strongest safe haven investment, along with US Treasuries, during times of severe financial instability.

Japan’s currency is also considered to be fundamentally cheaper in comparison to its peers and coupled with the country’s policy of low interest rates, the yen becomes an alluring funding currency.

“The idea of a funding currency is that the trader will be looking to make a profit on the difference between the cost of borrowing one currency, to finance the buying of another currency which has a higher interest rate," explains Ms Cincotta.

Yahoo Finance

Yahoo Finance