Does Oracle's (ORCL) Cloud Strength Make It Worth Buying Now?

As investors navigate the ever-changing technology landscape, the question of whether to invest in Oracle ORCL has become increasingly compelling. ORCL has undergone significant transformations in recent years, transitioning from traditional on-premises solutions to cloud-based offerings.

Oracle's growth prospects hinge significantly on the success of its cloud strategy. Its cloud offerings include infrastructure-as-a-service, platform-as-a-service, and software-as-a-service solutions. In fiscal 2024, Oracle's cloud services and license support segment generated revenue of $39.3 billion, accounting for 74% of the company's total revenues.

For the first quarter of fiscal 2025, total cloud revenues are expected to grow in the range of 21% to 23% in constant currency and 20% to 22% in dollar terms. Oracle expects fiscal year 2025 cloud infrastructure services to grow 50% faster than fiscal 2024.

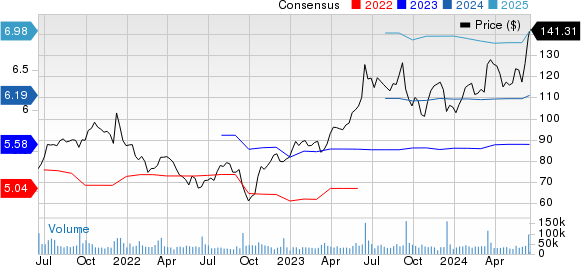

Oracle Corporation Price and Consensus

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

Oracle Doubles Down on Strategic Alliances

In a bid to accelerate top-line expansion, Oracle is intensifying its focus on forging and fortifying strategic partnerships across various sectors.

Oracle’s deepening relationship with Microsoft MSFT has been noteworthy. The two tech behemoths have been working together to offer interconnected cloud services, allowing customers to run workloads across Microsoft Azure and Oracle Cloud.

ORCL's strategic alliance with Alphabet GOOGL-owned Google Cloud, enables customers to seamlessly integrate OCI with Google Cloud's technologies, thereby accelerating application migrations and modernization initiatives. The collaboration's initial rollout spans 11 global regions, where Google Cloud's Cross-Cloud Interconnect eliminates cross-cloud data transfer charges for deploying workloads, reducing barriers to adoption and fostering a more fluid multi-cloud environment.

For the first quarter of fiscal 2025, total revenues are expected to grow in the range of 6% to 8% at constant currency and using the currency situation, as it is now, they are expected to grow in the range of 5% to 7% in dollar terms.

The Zacks Consensus Estimate for ORCL’s fiscal 2025 revenues is pegged at $57.45 billion, indicating year-over-year growth of 8.5%. The consensus mark for fiscal 2025 earnings is pegged at $6.14 per share, down a penny in the past 30 days. The figure indicates year-over-year growth of 10.4%.

Will Oracle's AI Prowess Act as a Catalyst?

As the AI landscape continues to evolve, Oracle's ability to deliver innovative and practical AI solutions for enterprises could play a pivotal role in shaping its growth trajectory and shareholder value.

Oracle's AI strategy is centered around embedding AI capabilities across its vast portfolio of products and services, ranging from cloud infrastructure and databases to enterprise applications and analytics tools. The company has been steadily enhancing its AI offerings, with a particular focus on areas like machine learning (ML), natural language processing, and computer vision.

One of Oracle's flagship AI products is the Autonomous Database, which leverages ML algorithms to automate various database tasks, such as tuning, securing and patching.

Recently, Oracle announced new AI innovations in the latest release of the Oracle APEX low-code development platform. The new APEX AI Assistant simplifies application development and helps developers quickly build feature-rich, mission-critical applications at scale.

Oracle has introduced AI-powered services like Oracle Digital Assistant, which enables businesses to build conversational interfaces for their applications, and Oracle AI Services, a suite of pre-trained models for tasks like language recognition, image analysis, and anomaly detection.

To bolster its AI capabilities in the near term, Oracle has formed strategic partnerships with companies like SambaNova Systems for AI hardware and NVIDIA NVDA for GPU-accelerated AI computing. These collaborations could help Oracle stay competitive in the rapidly evolving AI landscape.

Stiff Competition, Stretched Valuation Remain Overhangs

Oracle operates in a highly competitive market, facing intense competition from established tech giants like Microsoft, Amazon and Google, as well as newer players like Snowflake and Databricks.

While Oracle has a strong foothold in the database management and ERP software markets, its competitors are making significant inroads in the cloud space. AWS, Google Cloud and Microsoft Azure combined accounted for a whopping 67% of the $76 billion global cloud services market in the first quarter of 2024, according to new data from IT market research firm Synergy.

Shares of ORCL have gained 33.1% year to date compared with the Zacks Computer and Technology sector’s growth of 9.8%. While this performance may be encouraging for investors, it's important to consider whether the stock's current valuation accurately reflects the company's long-term growth potential and ability to navigate the competitive landscape.

ORCL is trading at a premium with a trailing 12-month EV/EBITDA of 19.2X compared with the Zacks Internet Software industry’s 18.25X, reflecting a stretched valuation.

Hence, investors should wait for a better entry point for Oracle, which currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance