What Does PagSeguro Digital Ltd.'s (NYSE:PAGS) Share Price Indicate?

PagSeguro Digital Ltd. (NYSE:PAGS) saw a double-digit share price rise of over 10% in the past couple of months on the NYSE. With many analysts covering the large-cap stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. But what if there is still an opportunity to buy? Let’s take a look at PagSeguro Digital’s outlook and value based on the most recent financial data to see if the opportunity still exists.

Check out our latest analysis for PagSeguro Digital

Is PagSeguro Digital still cheap?

PagSeguro Digital appears to be expensive according to my price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average. I’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 74.54x is currently well-above the industry average of 33.19x, meaning that it is trading at a more expensive price relative to its peers. If you like the stock, you may want to keep an eye out for a potential price decline in the future. Since PagSeguro Digital’s share price is quite volatile, this could mean it can sink lower (or rise even further) in the future, giving us another chance to invest. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

What does the future of PagSeguro Digital look like?

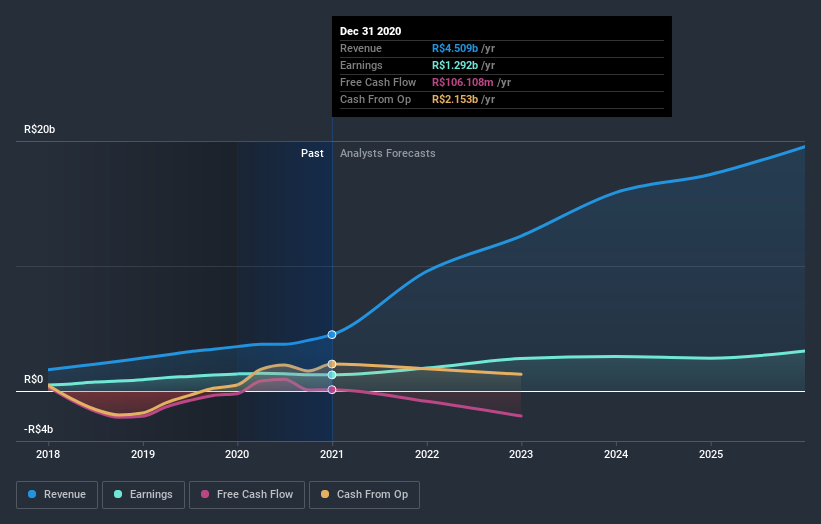

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. PagSeguro Digital's earnings over the next few years are expected to double, indicating a very optimistic future ahead. This should lead to stronger cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? PAGS’s optimistic future growth appears to have been factored into the current share price, with shares trading above industry price multiples. However, this brings up another question – is now the right time to sell? If you believe PAGS should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. But before you make this decision, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on PAGS for a while, now may not be the best time to enter into the stock. The price has surpassed its industry peers, which means it is likely that there is no more upside from mispricing. However, the positive outlook is encouraging for PAGS, which means it’s worth diving deeper into other factors in order to take advantage of the next price drop.

It can be quite valuable to consider what analysts expect for PagSeguro Digital from their most recent forecasts. Luckily, you can check out what analysts are forecasting by clicking here.

If you are no longer interested in PagSeguro Digital, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance