Does Sophos (LON:SOPH) have enough liquid assets?

Business distress and bankruptcy can put a dent in your portfolio no matter how well diversified you are.

That's why paying attention to simple checklists that flag up risky stocks is so important. Stockopedia provides many of these screening tools to help investors safely navigate the stock markets. One of them - the Altman Z-Score - was found to be:

72% accurate in predicting bankruptcy two years prior to the event in its initial test

80-90% accurate in predicting bankruptcy one year before the event in the 31 years up until 1999

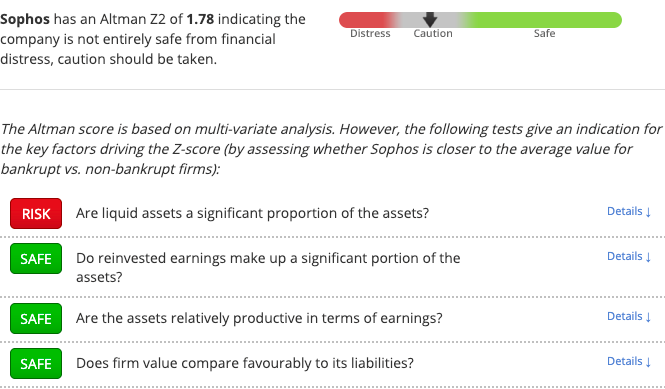

A Z-Score of more than 2.99 is considered to be a safe company. Those with a Z-Score of less than 1.8, on the other hand, have been shown to have a significant risk of financial distress within two years. We can see the checklist in action by applying it to a listed company. Take large cap high flyer Sophos (LON:SOPH), for example.

How does Sophos fare against Altman’s influential checklist?

GET MORE DATA-DRIVEN INSIGHTS INTO LON:SOPH »

What does the Altman Z-Score flag up about Sophos?

Unfortunately, Sophos fails Altman’s test with a Z-Score of 1.78...

Sophos's low Z-Score doesn't mean that it is definitely heading for financial distress, but it does mean this fate is more of a risk for Sophos than it is for most.

Specifically, our algorithms flag the following liquidity risk:

Fortify your portfolio with simple, effective tools

The problem areas for Sophos identified here can be explored in more depth on Stockopedia's research platform. All the best investors have stringent due diligence processes that reduce the chances of them suffering big losses, so why not take a leaf out of their book?

Simple tools can help us better measure and understand the risks we take. That's why the Stockopedia team has been busy building new ways of understanding investment risks and company characteristics. In this webinar, we talk about two or our most popular innovations: StockRank Styles and RiskRatings. These indicators transform a ton of vital financial information into intuitive classifications, allowing you to get an instant feel for any company on any market - sign up for a free trial to see how your stocks stack up.

Yahoo Finance

Yahoo Finance