Does Target Healthcare REIT PLC (LON:THRL) Have A Place In Your Dividend Stock Portfolio?

Dividend paying stocks like Target Healthcare REIT PLC (LON:THRL) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

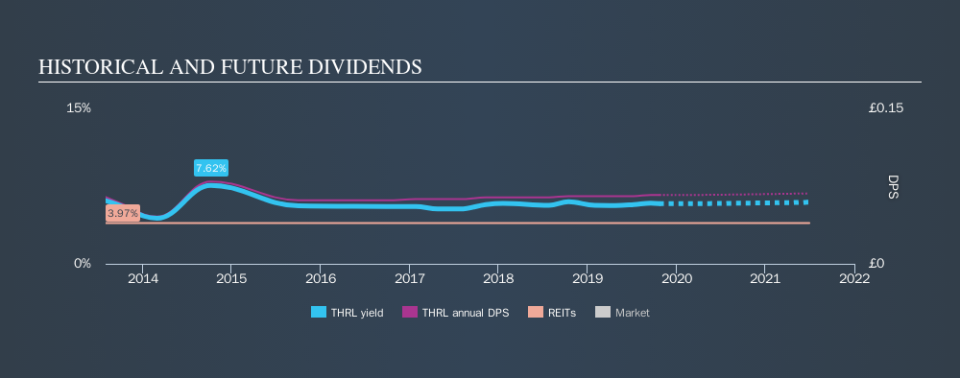

In this case, Target Healthcare REIT likely looks attractive to dividend investors, given its 5.8% dividend yield and six-year payment history. It sure looks interesting on these metrics - but there's always more to the story . Some simple analysis can reduce the risk of holding Target Healthcare REIT for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Target Healthcare REIT!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Target Healthcare REIT paid out 130% of its profit as dividends. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. With a cash payout ratio of 130%, Target Healthcare REIT's dividend payments are poorly covered by cash flow. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term. As Target Healthcare REIT's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

REITs like Target Healthcare REIT often have different rules governing their distributions, so a higher payout ratio on its own is not unusual.

Remember, you can always get a snapshot of Target Healthcare REIT's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the data, we can see that Target Healthcare REIT has been paying a dividend for the past six years. It's good to see that Target Healthcare REIT has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past six-year period, the first annual payment was UK£0.065 in 2013, compared to UK£0.067 last year. Its dividends have grown at less than 1% per annum over this time frame.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Target Healthcare REIT has grown its earnings per share at 60% per annum over the past five years. The company has been growing its EPS at a very rapid rate, while paying out virtually all of its income as dividends. Generally, a company that is growing rapidly while paying out a majority of its earnings, is seeing its debt burden increase. We'd be conscious of any extra risk added by this practice.

We'd also point out that Target Healthcare REIT issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. It's a concern to see that the company paid out such a high percentage of its earnings and cashflow as dividends. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. Overall, Target Healthcare REIT falls short in several key areas here. Unless the investor has strong grounds for an alternative conclusion, we find it hard to get interested in a dividend stock with these characteristics.

See if management have their own wealth at stake, by checking insider shareholdings in Target Healthcare REIT stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance