Does Tiong Woon Corporation Holding's (SGX:BQM) Share Price Gain of 42% Match Its Business Performance?

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Tiong Woon Corporation Holding Ltd (SGX:BQM) share price is up 42% in the last three years, clearly besting the market return of around 6.8% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 28% in the last year , including dividends .

See our latest analysis for Tiong Woon Corporation Holding

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, Tiong Woon Corporation Holding moved from a loss to profitability. So we would expect a higher share price over the period.

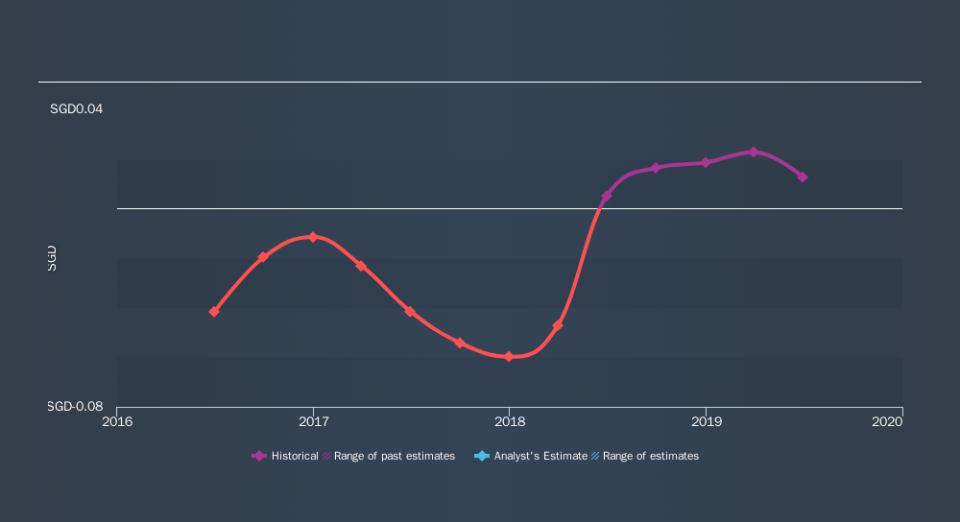

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Tiong Woon Corporation Holding's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Tiong Woon Corporation Holding's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Tiong Woon Corporation Holding's TSR of 43% over the last 3 years is better than the share price return.

A Different Perspective

We're pleased to report that Tiong Woon Corporation Holding shareholders have received a total shareholder return of 28% over one year. And that does include the dividend. Notably the five-year annualised TSR loss of 7.0% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Before forming an opinion on Tiong Woon Corporation Holding you might want to consider these 3 valuation metrics.

Of course Tiong Woon Corporation Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance