Does YRC Worldwide (NASDAQ:YRCW) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that YRC Worldwide Inc. (NASDAQ:YRCW) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for YRC Worldwide

What Is YRC Worldwide's Net Debt?

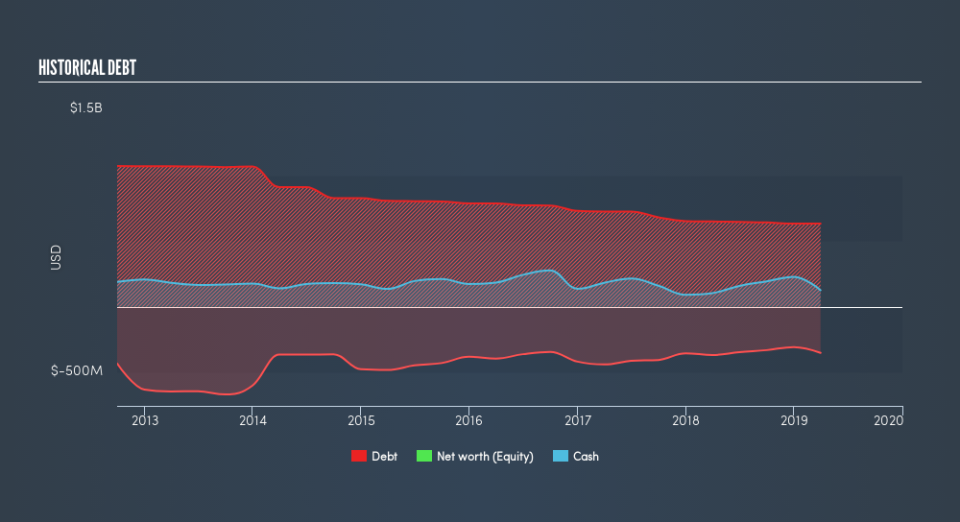

The chart below, which you can click on for greater detail, shows that YRC Worldwide had US$874.2m in debt in March 2019; about the same as the year before. On the flip side, it has US$126.6m in cash leading to net debt of about US$747.6m.

How Strong Is YRC Worldwide's Balance Sheet?

The latest balance sheet data shows that YRC Worldwide had liabilities of US$716.2m due within a year, and liabilities of US$1.56b falling due after that. Offsetting this, it had US$126.6m in cash and US$513.6m in receivables that were due within 12 months. So it has liabilities totalling US$1.64b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the US$112.4m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt At the end of the day, YRC Worldwide would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't blink an eye at YRC Worldwide's net debt to EBITDA ratio of 3.0, we think its super-low interest cover of 0.92 times is a bad sign. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Notably, YRC Worldwide's EBIT was pretty flat over the last year, which isn't ideal given the debt load. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if YRC Worldwide can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Considering the last three years, YRC Worldwide actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

To be frank both YRC Worldwide's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least its EBIT growth rate is not so bad. After considering the datapoints discussed, we think YRC Worldwide has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Even though YRC Worldwide lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check outhow earnings have been trending over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance