Dolby (DLB) Q3 Earnings Beat Estimates on Top-line Growth

Dolby Laboratories, Inc. DLB reported mixed third-quarter fiscal 2021 (ended Jun 25, 2021) results, with earnings declining year over year but sales witnessing a rise. Both the bottom and top lines surpassed their respective Zacks Consensus Estimate. Despite accelerated adoption of Dolby Vision and Dolby Atmos, weakness across the global cinema market and macroeconomic uncertainties, along with supply chain disruptions due to COVID restrictions, continue to hamper its operating momentum.

Net Income

On a GAAP basis, net income in the June quarter was $54.6 million or 52 cents per share compared with $67.3 million or 66 cents per share in the year-ago quarter. Despite top-line expansion, the year-over-year decrease was primarily due to benefit from income taxes in the prior-year quarter and higher operating expenses in the reported quarter.

Non-GAAP net income came in at $74.8 million or 71 cents per share compared with $87.5 million or 86 cents per share in the prior-year quarter. The bottom line beat the Zacks Consensus Estimate by 23 cents.

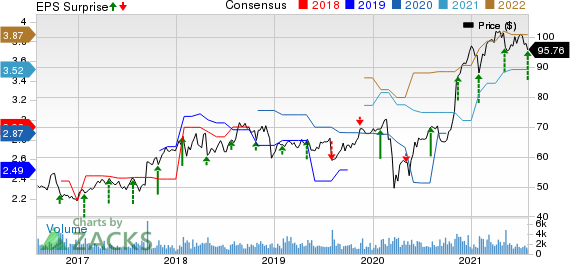

Dolby Laboratories, Inc. Price, Consensus and EPS Surprise

Dolby Laboratories, Inc. price-consensus-eps-surprise-chart | Dolby Laboratories, Inc. Quote

Revenues

Total revenues amounted $286.8 million, up 16.2% from $246.9 million in the year-ago quarter. The upside was driven by higher market volume and healthy traction of Dolby Vision and Dolby Atmos technologies. The top line surpassed the Zacks Consensus Estimate of $276 million.

Dolby Atmos’ launch on Apple Music accompanied with Comcast Corporation CMCSA offering the Tokyo Summer Olympic Games in both Dolby Vision HDR and Dolby Atmos immersive audio bolstered the adoption of these premium technologies across a diverse set of customers, thereby strengthening market penetration. This represents significant growth opportunity for the company.

Segment Performance

Revenues from Licensing were $271.6 million, up 15.5% year over year. Broadcast Licensing contributed 46% to total licensing revenues in the fiscal third quarter. Mobile licensing accounted for 18%, consumer electronics 14%, PC licensing 9% and licensing from other markets contributed to 13% of the licensing revenues. Products and services revenues came in at $15.2 million, up 29.2% year over year. Nevertheless, the global cinema market continues to be hampered by the impact of COVID-19 pandemic with uncertainties related to when the movie theaters will be operating at full capacity.

Other Details

Gross profit in the fiscal third quarter was $255.2 million compared with $217 million in the year-earlier quarter. Total operating expenses jumped 8.8% to $199.1 million, primarily due to higher sales and marketing expenses. Operating income was $56.1 million compared with $34.1 million in the year-ago quarter.

Cash Flow and Liquidity

During the first nine months of fiscal 2021, Dolby generated $338 million of net cash from operating activities compared with $231.2 million a year ago. As of Jun 25, 2021, the company had $1,219.6 million in cash and cash equivalents with $115.2 million of other non-current liabilities.

Q4 and Full-Year Fiscal 2021 Guidance

Despite uncertainties pertaining to the virus outbreak, Dolby provided guidance for fourth-quarter and full-year fiscal 2021.

For the fourth quarter, the company expects GAAP earnings in the range of 25-40 cents per share and non-GAAP earnings in the range of 47-62 cents per share on revenues of $280-$310 million. Unit volume shipments across various end markets and devices are likely to be hampered by the COVID-19 adversities. On a GAAP basis, operating expenses are expected in the $216-$226 million band, whereas on a non-GAAP basis, operating expenses are anticipated in the range of $190-$200 million.

For full-year fiscal 2021, the company expects GAAP earnings in the range of $2.79-$2.94 per share and non-GAAP earnings in the range of $3.57-$3.72 per share on revenues of $1.28-$1.31 billion. On a GAAP basis, operating expenses are expected in the $810-$820 million band, whereas on a non-GAAP basis, operating expenses are anticipated in the range of $710-$720 million.

Due to uncertainty in global financial markets, unemployment and supply chain disruptions, Dolby’s near-term performance might get affected across various end markets. Although its products and services revenues are likely to be hurt by the downturn of the cinema industry owing to the catastrophe, Dolby is committed to supporting its business operations in this hour of crisis.

Zacks Rank & Stocks to Consider

Dolby currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader industry are The E.W. Scripps Company SSP and Shaw Communications Inc. SJR. While E.W. Scripps sports a Zacks Rank #1 (Strong Buy), Shaw Communications carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

E.W. Scripps delivered a trailing four-quarter earnings surprise of 197.6%, on average.

Shaw Communications delivered a trailing four-quarter earnings surprise of 32.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dolby Laboratories (DLB) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Shaw Communications Inc. (SJR) : Free Stock Analysis Report

E.W. Scripps Company The (SSP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance