Dollar General (DG) Gears Up for Q1 Earnings: What's in Store?

Dollar General Corporation DG is likely to register an increase in the top line when it reports first-quarter fiscal 2023 results on Jun 1 before the opening bell. The Zacks Consensus Estimate for revenues is pegged at $9,469 million, indicating an improvement of 8.2% from the prior-year quarter’s level.

The bottom line of this discount retailer is expected to have decreased from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for first-quarter earnings per share has been stable at $2.38 over the past 30 days, suggesting a decline of 1.2% from the year-ago period’s reported number.

Dollar General has a trailing four-quarter negative earnings surprise of 0.6%, on average. In the last reported quarter, this Goodlettsville, TN-based player beat the Zacks Consensus Estimate by 0.7%.

Key Factors to Note

Dollar General’s better pricing, private-label offerings and effective inventory management are likely to have contributed to the to-be-reported quarter’s top line. The company’s operational capabilities, coupled with its real estate growth strategy, position it well to gain market share by targeting low-to-middle-income-group consumers. It has also been focusing on consumable and non-consumable categories to boost traffic.

We also remain encouraged by the company’s host of initiatives, such as DG Fresh, Fast Track, digitization and private fleet. These are likely to have contributed to same-store sales.

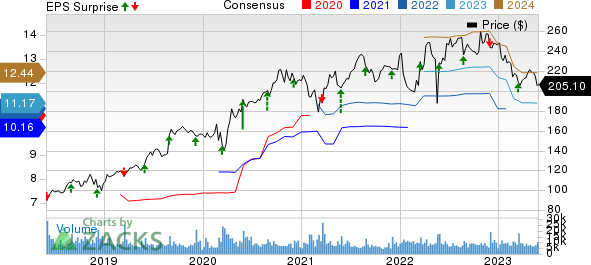

Dollar General Corporation Price, Consensus and EPS Surprise

Dollar General Corporation price-consensus-eps-surprise-chart | Dollar General Corporation Quote

However, margins remain an area to watch. On its last earnings call, management hinted at soft earnings growth in the first half. This is due to the expectation of continued headwinds from sales mix pressure, higher interest expenses, and increased shrink and damages. The company anticipated certain headwinds to be more pronounced in the first quarter. This included an estimated year-over-year increase in interest expenses of approximately $40 million.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Dollar General this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here.

Dollar General has a Zacks Rank #3 but an Earnings ESP of -1.36%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this season:

Costco COST currently has an Earnings ESP of +0.04% and a Zacks Rank #3. The company is likely to register a bottom-line increase when it reports third-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for the quarterly earnings per share of $3.32 suggests an increase of 4.7% from the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco’s top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $54.6 billion, which indicates an increase of 3.8% from the figure reported in the prior-year quarter. Costco has a trailing four-quarter earnings surprise of 2.4%, on average.

Macy’s M currently has an Earnings ESP of +2.81% and a Zacks Rank of #3. The company is likely to register a decline in the bottom line when it reports first-quarter fiscal 2023 results. The Zacks Consensus Estimate for the quarterly earnings per share of 46 cents suggests a decrease of 57.4% from the year-ago quarter.

Macy’s top line is expected to decline year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $5.11 billion, which suggests a drop of 4.4% from the figure reported in the prior-year quarter. Macy’s delivered an earnings beat of 60.7%, on average, in the trailing four quarters.

Dollar Tree DLTR currently has an Earnings ESP of +0.59% and a Zacks Rank #3. The company is expected to register a decrease in the bottom line when it reports second-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of $1.17 suggests a decline of 26.9% from the year-ago quarter.

Dollar Tree’s top line is anticipated to rise year over year. The consensus mark for revenues is pegged at $7.17 billion, indicating an increase of 6.1% from the figure reported in the year-ago quarter. DLTR has a trailing four-quarter earnings surprise of 0.4%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance