Domino's (DPZ) Q4 Earnings Match Estimates, Revenues Miss

Domino’sPizza, Inc.’s DPZ fourth-quarter 2017 earnings matched the Zacks Consensus Estimate while revenues missed the same.

Adjusted earnings came in at $1.94 per share and improved 31.1% year over year on higher net income and lower diluted share count as a result of share repurchases.

Quarterly revenues were up 8.8% year over year to $891.5 million but missed the Zacks Consensus Estimate by 1.1%. The improvement was backed by higher supply chain revenues as well as higher royalties from retail sales and positive currency impacts.

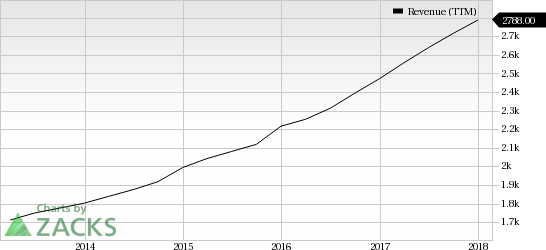

Domino's Pizza Inc Revenue (TTM)

Domino's Pizza Inc Revenue (TTM) | Domino's Pizza Inc Quote

Notably, the fourth quarter marked the 27th consecutive quarter of positive U.S. comparable sales and 96th consecutive quarter of positive international comps. Meanwhile, the company continues to increase store count at a decent pace and opened more than 400 net new stores in the quarter.

In a year’s time, Domino’s shares have rallied 17.2% outperforming 8.5% gain of the industry it belongs to.

Let’s delve deeper in to the numbers.

Comps

Global retail sales (including total sales of franchise and company-owned units) were up 11.7% year over year. The uptick was primarily owing to strong comps from international stores. Excluding foreign currency impact, global retail sales increased 9.9%.

In the quarter under review, the company’s domestic stores (including company-owned and franchise stores) comps improved 4.2%. This compared unfavorably with 7.7% growth in the year-ago quarter and an 8.4% rise in the previous quarter.

At domestic company-owned stores, Domino’s experienced year-over-year comps growth of 3.8%, lower than 8.7% comps growth in the year-ago quarter and an 8.4% rise last quarter. Also, domestic franchise stores comps grew 4.2% comparatively lower than comps growth of 7.6% and 8.4%, in the year-ago quarter and the preceding quarter, respectively.

Comps at international stores, excluding foreign currency translation, were up 12.1%. This was better than the prior-quarter improvement of 5.1% but lower than the year-ago quarter rise of 14.8%.

Margins

Domino’s operating margin increased 40 bps year over year to 31.5% in the quarter under review. Also, the net income margin rose 160 bps to 10.5%. The uptick in the company’s net income was primarily driven by an increase in comps growth and store count as well as higher supply chain volumes and global royalty revenues. The adoption of the new equity-based compensation accounting standard too drove net income. However, the increase was partially offset by rise in net interest expenses on higher net debt levels.

Balance Sheet

As of Dec 31, 2017, cash and cash equivalents were $35.8 million down from $42.8 million as of Jan 1, 2017. Long-term debt as of Dec 31, 2017 was $3.1 billion, down from $2.1 billion million as of Jan 1, 2017.

Inventory, at the end of the fourth quarter, amounted to $40 million, down from $40.2 billion in fourth-quarter of 2016.

Cash flows from operating activities as of Dec 31, 2017 was $339 million compared with $287.2 million as of Jan 1, 2017.

Domino’s spent $90 million on capital expenditures, $84 million on dividends and $1.1 billion on share repurchase in 2017.

Zacks Rank & Peer Releases

Domino's carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chipotle Mexican Grill CMG posted mixed fourth-quarter 2017 results, with adjusted earnings of $1.34 per share surpassing the consensus estimate of $1.32 by 1.5%. The bottom line also grew 143.6% year over year on lower costs and higher revenues.

McDonald's MCD reported fourth-quarter 2017 adjusted earnings per share (EPS) of $1.71, beating the consensus mark of $1.59 by 7.5%. The bottom line also improved 19% from the year-ago quarter (16% in constant currencies). The upside reflects strong operating performance and G&A savings.

Dunkin' Brands’ DNKN fourth-quarter 2017 adjusted earnings of 64 cents per share topped the Zacks Consensus Estimate of 63 cents. Earnings, however, stayed flat year over year as a decline in adjusted net income was offset by decrease in shares outstanding.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance