Don't Buy Orica Limited (ASX:ORI) For Its Next Dividend Without Doing These Checks

Orica Limited (ASX:ORI) stock is about to trade ex-dividend in 3 days time. Investors can purchase shares before the 28th of May in order to be eligible for this dividend, which will be paid on the 8th of July.

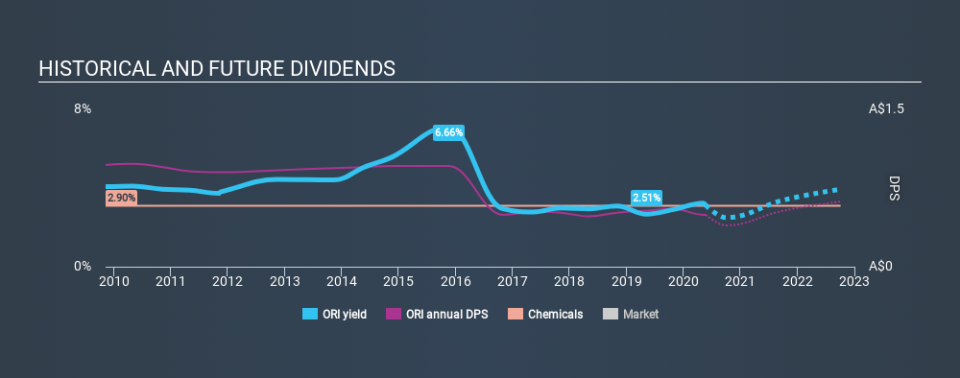

Orica's next dividend payment will be AU$0.17 per share. Last year, in total, the company distributed AU$0.49 to shareholders. Based on the last year's worth of payments, Orica stock has a trailing yield of around 2.9% on the current share price of A$16.84. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Orica

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Orica is paying out an acceptable 50% of its profit, a common payout level among most companies. A useful secondary check can be to evaluate whether Orica generated enough free cash flow to afford its dividend. Orica paid out more free cash flow than it generated - 119%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

While Orica's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Orica to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Readers will understand then, why we're concerned to see Orica's earnings per share have dropped 8.4% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

We'd also point out that Orica issued a meaningful number of new shares in the past year. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Orica has seen its dividend decline 6.5% per annum on average over the past ten years, which is not great to see. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

Final Takeaway

Should investors buy Orica for the upcoming dividend? Orica had an average payout ratio, but its free cash flow was lower and earnings per share have been declining. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

So if you're still interested in Orica despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Every company has risks, and we've spotted 4 warning signs for Orica you should know about.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance