Don't Ignore the Momentum in These 3 Stocks

As we begin to head into the summer months, one thing remains undeniable: stocks have been much stronger in 2023 compared to last year’s rough showing, undoubtedly a welcomed development.

Many stocks have rebounded in a big way so far, with some breaking out to new 52-week highs, including Novo Nordisk NVO, Lamb Weston LW, and Radian Group RDN. Below is a chart illustrating the performance of all three in 2023, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three have displayed considerable momentum year-to-date, crushing the S&P 500’s impressive 9% gain. For those interested in riding the relative strength, let’s take a closer look at each.

Lamb Weston

Lamb Weston is a leading global manufacturer, marketer, and distributor of value-added frozen potato products. The stock is presently a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

LW has consistently posted strong quarterly results as of late, exceeding the Zacks Consensus EPS Estimate by double-digit percentages in six consecutive quarters. Just in its latest release, Lamb Weston registered a 46% EPS beat and reported revenue 6.5% above expectations.

Image Source: Zacks Investment Research

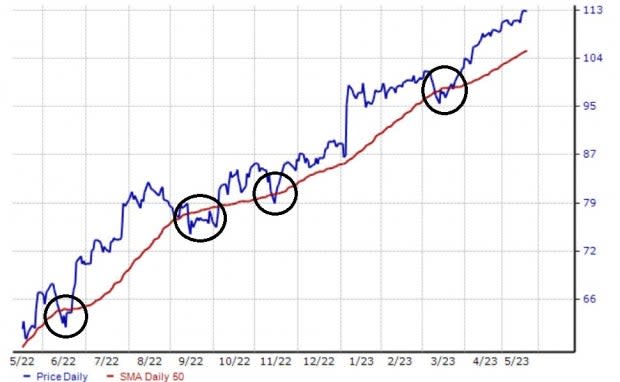

Investors could use the 50-day moving average as a potential entry point, as the level has consistently provided support over the last year. This is illustrated in the chart below.

Image Source: Zacks Investment Research

Novo Nordisk

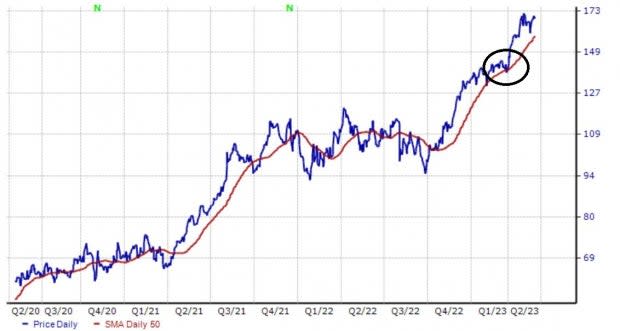

Novo Nordisk is a global healthcare company and a leader in the worldwide diabetes market. As we can see below, analysts have increased their earnings expectations over the last several months, helping land the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

In addition, NVO shares are expensive on a relative basis, with the current 34.6X forward earnings multiple sitting well above the 24.4X five-year median and the Zacks Medical sector average. The steep valuation picture could cause some selling pressure, a development investors should be highly aware of.

Image Source: Zacks Investment Research

If shares see a correction, expect the 50-day moving average to become an area of interest, a level that shares have recently bounced off of.

Image Source: Zacks Investment Research

Radian Group

Radian Group, a credit enhancement company, supports homebuyers, mortgage lenders, loan servicers, and investors with a suite of private mortgage insurance and related risk-management products and services. Like the stocks above, RDN sports the highly-coveted Zacks Rank #1 (Strong Buy).

Shares don’t appear stretched in terms of valuation, with the current 7.6X forward earnings multiple sitting a few ticks below the five-year median and the Zacks Finance sector average.

The stock carries a Style Score of “B” for Value.

Image Source: Zacks Investment Research

In addition, shares do pay a solid dividend, currently yielding 3.6% annually. Impressively, the company has more than doubled its payout over the last years, fully reflecting a commitment to increasingly rewarding its shareholders.

Image Source: Zacks Investment Research

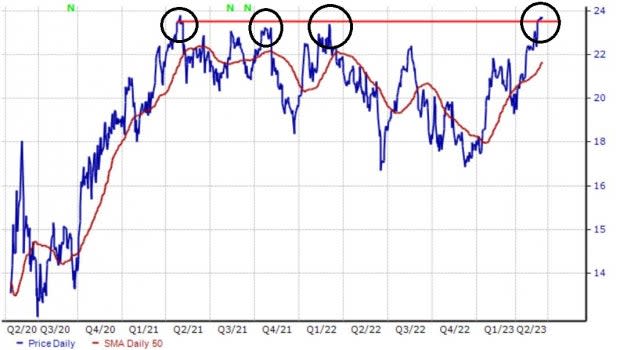

Shares are now breaking out of a several-year-long range, as we can see illustrated below. Previously, RDN shares have failed to hold their momentum at this level, but the company’s improved earnings outlook could fuel shares well above.

Image Source: Zacks Investment Research

Bottom Line

Momentum investing is centered around targeting stocks displaying outperformance. And when you add in the Zacks Rank, the strategy can become even more powerful.

And that’s precisely what all three stocks above – Novo Nordisk NVO, Lamb Weston LW, and Radian Group RDN – have displayed, breaking out to new 52-week highs on the back of improved earnings outlooks.

Still, it’s essential for investors to carefully place stop losses at comfortable thresholds, as the momentum swing can quickly turn negative.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance