Don't Race Out To Buy Pzena Investment Management, Inc (NYSE:PZN) Just Because It's Going Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Pzena Investment Management, Inc (NYSE:PZN) is about to trade ex-dividend in the next 3 days. Investors can purchase shares before the 29th of October in order to be eligible for this dividend, which will be paid on the 20th of November.

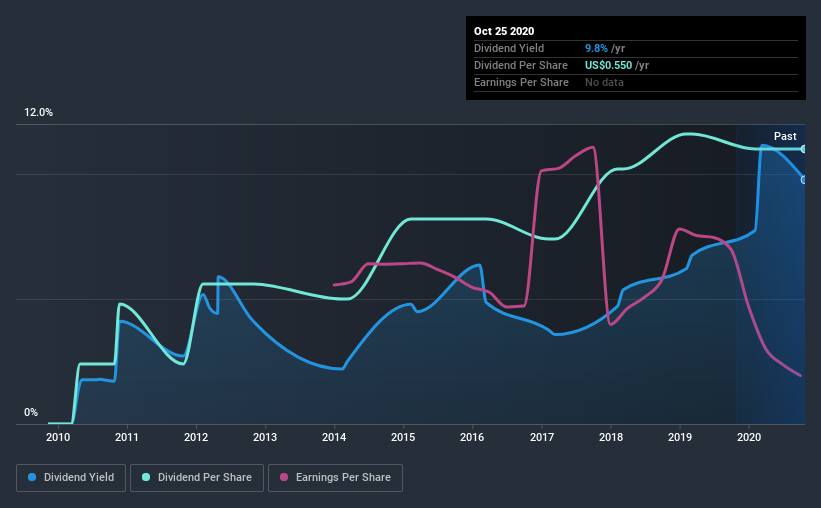

Pzena Investment Management's next dividend payment will be US$0.03 per share, on the back of last year when the company paid a total of US$0.55 to shareholders. Looking at the last 12 months of distributions, Pzena Investment Management has a trailing yield of approximately 9.8% on its current stock price of $5.63. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Pzena Investment Management

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. An unusually high payout ratio of 284% of its profit suggests something is happening other than the usual distribution of profits to shareholders.

When a company pays out a dividend that is not well covered by profits, the dividend is generally seen as more vulnerable to being cut.

Click here to see how much of its profit Pzena Investment Management paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Readers will understand then, why we're concerned to see Pzena Investment Management's earnings per share have dropped 21% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Pzena Investment Management has increased its dividend at approximately 16% a year on average. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Pzena Investment Management is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

Final Takeaway

Is Pzena Investment Management worth buying for its dividend? Earnings per share are in decline and Pzena Investment Management is paying out what we feel is an uncomfortably high percentage of its profit as dividends. It's not that we hate the business, but we feel that these characeristics are not desirable for investors seeking a reliable dividend stock to own for the long term. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

So if you're still interested in Pzena Investment Management despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. We've identified 4 warning signs with Pzena Investment Management (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance