DoorDash Inc (DASH) Q1 2024 Earnings: Surpasses Revenue Forecasts Despite Challenges

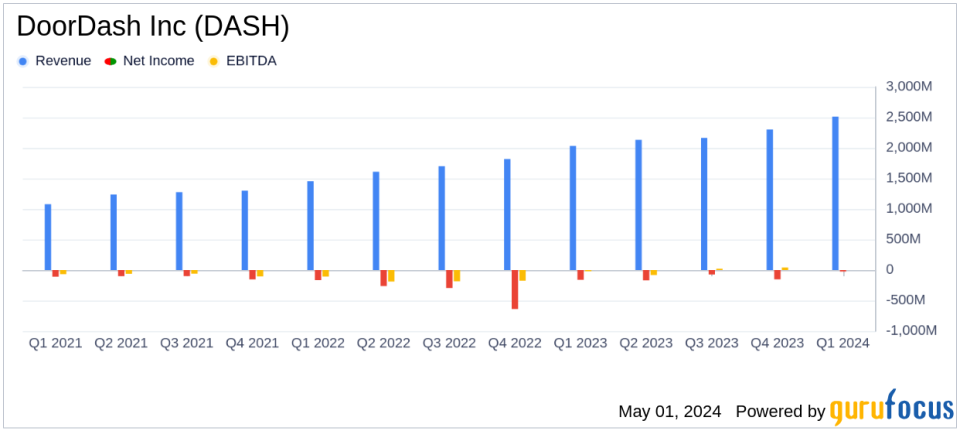

Revenue: Reached $2.5 billion in Q1 2024, marking a 23% increase year-over-year, surpassing the estimated $2.452 billion.

Net Loss: Improved significantly to $25 million in Q1 2024 from $162 million in Q1 2023, above the estimated net loss of $23.54 million.

Total Orders: Grew by 21% year-over-year to 620 million, indicating strong demand and operational execution.

Adjusted EBITDA: Increased to $371 million from $204 million in the previous year, reflecting enhanced operational efficiency and profitability.

Marketplace GOV: Increased by 21% year-over-year to $19.2 billion, driven by expanded service offerings and market penetration.

Free Cash Flow: Rose to $487 million, up from $316 million in Q1 2023, demonstrating improved cash generation capabilities.

Net Revenue Margin: Improved slightly to 13.1% in Q1 2024 from 12.8% in Q1 2023, benefiting from higher-margin services.

On May 1, 2024, DoorDash Inc (NASDAQ:DASH) released its financial results for the first quarter ended March 31, 2024, detailed in its 8-K filing. The company reported significant growth in several key areas, despite facing regulatory challenges and increased costs.

Company Overview

Founded in 2013 and headquartered in San Francisco, DoorDash operates as an online food order and delivery service aggregator. It provides a platform for restaurants and other merchants to offer food and goods deliveries in the U.S. and, following its acquisition of Wolt in 2022, in Europe as well. The company aims to enhance local commerce by facilitating on-demand delivery and pickup services.

Financial Performance Highlights

DoorDash reported a 23% year-over-year increase in revenue, reaching $2.5 billion, which surpassed the estimated $2.45 billion. This growth was driven by a 21% increase in both Total Orders and Marketplace Gross Order Value (GOV), which stood at 620 million and $19.2 billion, respectively. Notably, the company's net loss improved significantly, decreasing to $25 million from $162 million in the same quarter the previous year.

Operational Efficiency and Market Expansion

The company's operational improvements have been pivotal. By enhancing logistics and expanding service offerings beyond restaurants to include groceries and other retail items, DoorDash has not only increased its market penetration but also its operational efficiency. This is evident from the Adjusted EBITDA, which rose to $371 million from $204 million year-over-year.

Challenges and Regulatory Impacts

Despite its growth, DoorDash faced increased costs due to new earnings standards implemented in Seattle and New York City, which have unfavorably impacted local merchants and reduced the flexibility and earnings potential for Dashers. The company estimates that these regulations have decreased local merchant earnings significantly and increased wait times for Dashers, highlighting a potential area of concern for future operational flexibility.

Strategic Initiatives and Future Outlook

DoorDash is actively engaging in strategic initiatives to counteract regulatory challenges, including a pilot program in Pennsylvania to test portable benefits for Dashers. Looking ahead, the company forecasts a Marketplace GOV between $19.0 billion and $19.4 billion for Q2 2024, with an Adjusted EBITDA of $325 million to $425 million. These projections reflect DoorDash's ongoing efforts to innovate and adapt in a dynamic market.

Financial Health and Investor Insights

The balance sheet remains robust with an increase in cash and cash equivalents to $3.1 billion. The company's disciplined cost management and strategic investments in new markets and product categories are poised to support long-term growth. However, investors should be mindful of the potential risks associated with increased regulatory scrutiny and the costs of expansion into new service areas.

Overall, DoorDash's Q1 2024 performance illustrates a company that is successfully navigating market challenges while continuing to expand its footprint and improve operational efficiency. As it adapts to regulatory changes and explores new market opportunities, DoorDash remains a significant player in the evolving landscape of digital commerce and delivery services.

For further details, please refer to the full earnings report and join the upcoming earnings webcast detailed on DoorDash's Investor Relations page.

Explore the complete 8-K earnings release (here) from DoorDash Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance