Dover's (DOV) OPW Clean Energy Solutions Expand Product Line

Dover Corporation DOV announced that ACME Cryogenics, which is part of OPW Clean Energy Solutions, has developed new 6" and 8" valves for its Model CV Valve product line. This was developed after the global expansion of hydrogen infrastructure.

This move will allow the company to satisfy the increasing customer demand for hydrogen valves with larger bore sizes.

The ACME Model CV valves have design and operating advantages that make them perfect for hydrogen handling while also being compatible with applications that need a vacuum-jacketed valve and piping system. Model CV valves can be used for hydrogen handling in a variety of markets and industries, including aerospace, food and beverage, electronics, vehicle refueling, industrial manufacturing, and medical.

ACME Cryogenics, founded in 1969 and headquartered in Allentown, PA, is a provider of highly engineered, mission-critical components and services for the production, storage and distribution of cryogenic gasses used in a range of applications. Dover acquired ACME Cryogenics and RegO Products (a leading provider of highly engineered flow-control solutions for cryogenic and liquified gas end markets) in December 2021 and formed OPW Clean Energy Solutions.

OPW Clean Energy Solutions falls under Dover’s Clean Energy & Fueling business segment. In the first quarter of 2024, the Clean Energy & Fueling segment’s revenues were $445 million compared with the prior-year quarter’s $431 million. The segment’s adjusted EBITDA was $77.5 million, down from the prior-year quarter’s $81 million.

The company reported first-quarter 2024 adjusted earnings per share (EPS) from continuing operations of $1.95, beating the Zacks Consensus Estimate of $1.88. The bottom line increased 1% year over year.

Total revenues in the first quarter increased 0.7% year over year to $2.1 billion. The top line surpassed the Zacks Consensus Estimate of $2 billion.

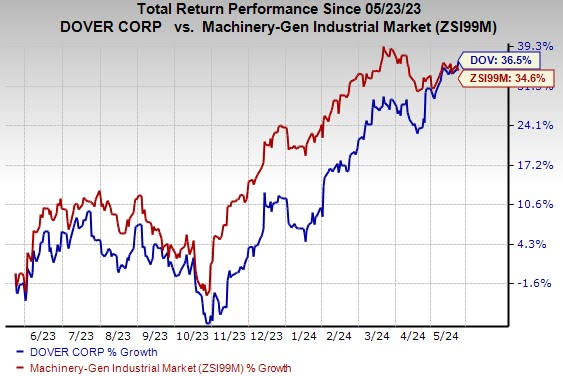

Price Performance

DOV shares have gained 36.5% in the past year compared with the industry’s growth of 34.6%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Dover currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Intellicheck, Inc. IDN, Applied Industrial Technologies AIT and ACCO Brands Corporation ACCO. IDN currently sports a Zacks Rank #1 (Strong Buy), and AIT and ACCO carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Intellicheck’s 2024 earnings is pegged at 2 cents per share. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 28.9%. IDN shares have gained 13.7% in the past year.

Applied Industrial has an average trailing four-quarter earnings surprise of 8.2%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.62 per share, which indicates year-over-year growth of 9.9%. Estimates have moved north by 2% in the past 60 days. The company’s shares have gained 60.1% in the past year.

The Zacks Consensus Estimate for ACCO Brands’ 2024 earnings is pegged at $1.07 per share. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 25.9%. ACCO shares have gained 1.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dover Corporation (DOV) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Acco Brands Corporation (ACCO) : Free Stock Analysis Report

Intellicheck Mobilisa, Inc. (IDN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance