Dow Jones 30 and NASDAQ 100 Price Forecast November 23, 2017, Technical Analysis

Dow Jones 30

The Dow Jones 30 has been very noisy during the trading session on Wednesday, as we head into the Thanksgiving weekend. It’s very likely that the Dow Jones 30 falling towards the 23,500 level in finding a bit of support towards the end of the day signifies that we are going to go higher over the longer term. If we were to break down below that level, I think we could go even lower, perhaps looking for value, but obviously that’s not going to happen over the next 48 hours as Americans are away for the Thanksgiving Day holiday and of course Friday as well. With this being the case, I suspect that you are better off to wait on the sidelines and see what Europe does before putting money to work. In general, I am bullish of this market and I think that the pullback should be a nice opportunity, but that’s for Monday. CFD markets might have movement, but it has nothing to do with reality.

Dow Jones 31 and NASDAQ Index Video 23.11.17

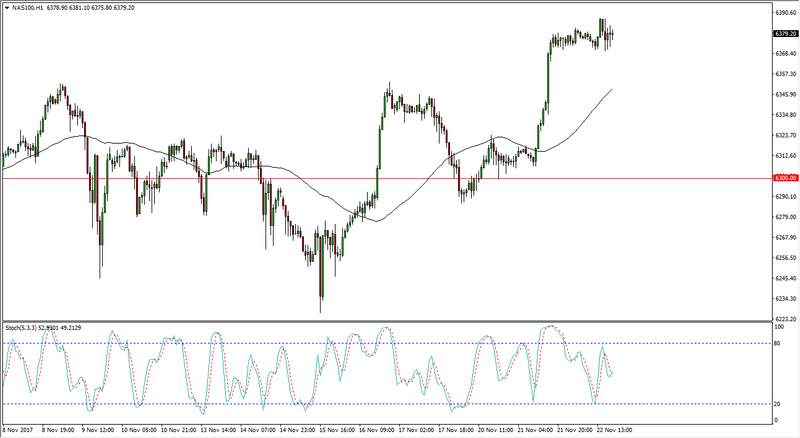

NASDAQ 100

The NASDAQ 100 continues to go sideways in general, as we have been shopping around and I think that at this point some type of pullback is a nice opportunity to take advantage of short-term volatility, as we should continue to see plenty of buying pressure with the 6300-level underneath offering a significant amount of support. I think that the market will eventually go looking towards the 6500 level, but obviously we need to get back to the normal liquidity of next week before we can take anything seriously in this market. I am bullish, but also patient enough to wait for true futures trading to follow in the CFD markets and will ignore movement between now and then.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance